Earn Upto

12% Returns

on India’s top rated Bank Bonds

Private Sector Banks

returns

Regulatory Overview of IndiaBonds

IndiaBonds, a SEBI Registered Stockbroker (Debt Segment) and Licensed Online Bond Platform Provider (OBPP), operates within the regulatory guidelines with SEBI Registration No. INZ000311637

Regulatory approved sale process

All your payments and Bond Settlement are routed directly via SEBI regulated Clearing Houses

Earn higher Returns

Earn upto 12% interest with Bank Bonds in comparison to average 6.5% on Fixed Deposits

No lock in period

Your investments can be sold anytime as bonds are tradable on exchanges

Safety

Banks are regulated by government through Reserve Bank of India and are monitored on regular basis for safety

Capital Appreciation

Bonds have potential for capital appreciation on improvement of issuer profile or interest rates

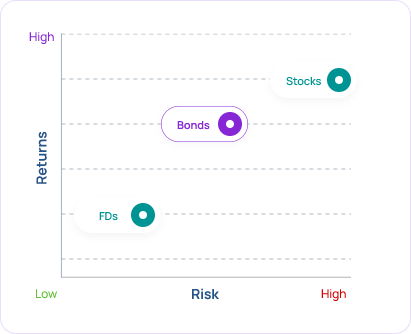

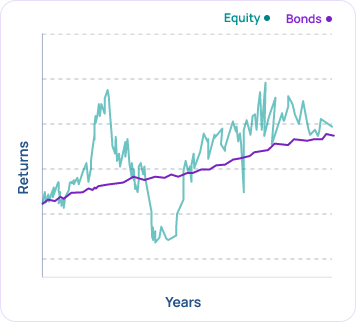

Less Volatile

Bond prices are stable vs volatile equity prices

Earn stable and regular returns

Bonds help you earn fixed and predictable returns in form of interest payments

Diversify your portfolio

Bonds help you diversify your prortfolio from other illiquid or volatile assets like equity, real estate, gold etc

SEBI Registered Stockbroker (Debt Segment)

Registered with SEBI as a Stockbroker (Debt Segment) and a Licensed Online Bond Platform Provider

Simple KYC Process

Complete your KYC online in just under 3 minutes. It’s paperless, easy and requires no uploads

Zero Brokerage

When you invest with IndiaBonds you pay no brokerage, commission or any hidden charges on secondary market bonds

Transparent Pricing

Get complete breakdown of the price you will invest. The price you see is the price you get