Blogs

All

Essential

Insights

Advanced

Sort by:Latest

>

6 min read

17 Jul, 2025

Essential

What Is a Floor?

In everyday life, a “floor” is something that supports you — it’s the base you stand on. In finance, the idea isn’t much different. A floor simply means a minimum value something shouldn’t fall below. Whether it’s interest rates, returns or the price of an asset, having a floor helps protect investors from bigger losses.

5 min read

01 Jul, 2025

Essential

What is Appreciation?

Imagine you purchased a small flat a few years back for ₹30 lakhs. Now, someone’s willing to pay ₹45 lakhs for it—that rise in value over time is what we call appreciation. It’s the quiet way wealth grows—without fanfare, without monthly reminders. The value simply rises over time. Appreciation shows up everywhere. In homes, stocks,

8 min read

18 Jun, 2025

Insights

What is SOFR?

Picture the world of big money – loans, investments, all that jazz. For ages, there was this go-to number called LIBOR, the London Interbank Offered Rate. It was the yardstick for figuring out interest rates on tons of stuff. But, things change, right? People started wanting something a bit more transparent, something that really showed

5 min read

11 Jun, 2025

What is Trade Settlement?

Okay, so you’ve clicked “buy” or “sell” on a bond. You might think, “Great, done deal!” But hold on a second. Just like buying a house involves more than signing a contract, bond trading has a final, crucial step: trade settlement. Think of it as the official handshake, the moment when the bond and the

5 min read

03 Jun, 2025

Essential

What Is Maturity Date?

Introduction When it comes to fixed-income investments, the maturity date is an important factor investors need to be aware of. Whether you’re investing in a bond, a fixed deposit or even a recurring deposit, the maturity date marks the end of the investment period and indicates when the principal amount is due to be repaid.

6 min read

23 May, 2025

Essential

What is Coupon Rate?

Imagine you’re thinking about lending some money, right? Buying a bond is kind of like that. The company or government you buy the bond from is borrowing from you. Now, for lending them your cash, they give you regular interest payments. The coupon rate is simply the fixed percentage of the original amount you lent

6 min read

25 Apr, 2025

Essential

What Is Cap in Investment?

When you hear the term cap in investment, think of a ceiling. Just like a physical cap keeps something from going too high, in the world of finance, it places a limit on how high the interest rate can rise. This becomes especially useful when you’re dealing with variable-rate instruments like bonds or loans. A

5 min read

09 Apr, 2025

Essential

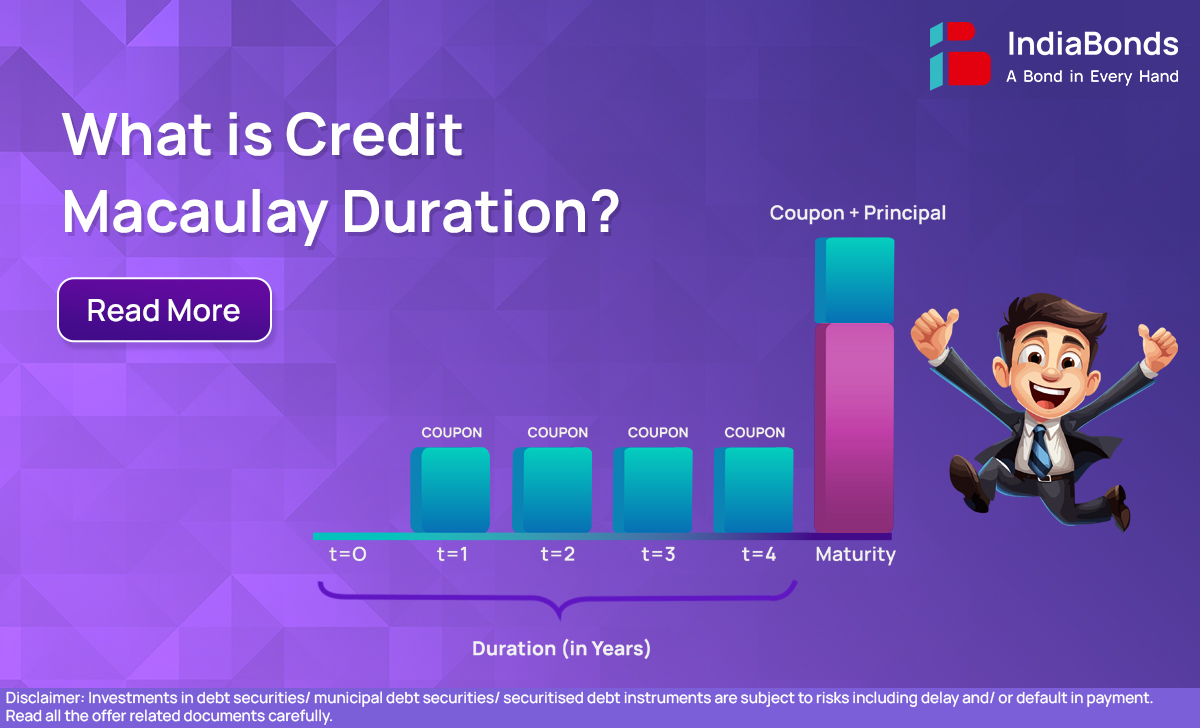

What is Credit Macaulay Duration?

Introduction When you invest in bonds, especially those issued by corporations or lower-rated entities, understanding how long your money is at risk and how sensitive the bond is to interest rate changes becomes critical. One widely used concept in the bond world is Macaulay Duration. It helps investors get a sense of when they’ll recover

6 min read

03 Apr, 2025

Essential

Consumer Price Index (CPI): Your Guide to Understanding Inflation’s Impact

CPI Demystified: More Than Just a Number Introduction: Imagine CPI as the economy’s thermometer. Just as a fever signals health issues, rising CPI indicates inflation heating up your daily expenses. In India, the Consumer Price Index tracks price changes for essentials like food, housing, transport, and healthcare. It’s not just a statistic—it’s a pulse check

7 min read

01 Apr, 2025

Essential

What is Bootstrapping? Building Empires Without Handouts

Picture this: You’re baking a cake, but instead of rushing to the store for fancy ingredients, you work with what’s in your pantry. That’s bootstrapping in a nutshell—crafting a business from scratch using grit, creativity, and the resources already at your fingertips. No investor sugar daddies, no loans—just raw hustle. Companies like Zoho and Mailchimp

5 min read

26 Mar, 2025

Essential

What is the Repo Rate?

In financial news, you must’ve heard the term “repo rate”, but what exactly does it mean for you and how does the repo rate affect a common man? Let’s understand. Imagine banks occasionally need quick cash—just like we do. Instead of a friend or relative, they turn to the Reserve Bank of India (RBI). But

4 min read

21 Mar, 2025

Essential

What is Compound Interest?

Picture this: you’ve got a little money pot, right? You put some rupees in there. Now, the bank, or wherever you keep it, gives you a little extra, like a bonus, for keeping your money with them. That’s called interest. Now, here’s the cool part: with compound interest, that bonus money? It starts earning its

Bonds you may like...

ESAF SMALL FINANCE BANK LIMITED

Coupon

11.2500%

Maturity

May 2029

Rating

Type of Bond

Subordinate Debt Tier 2

Yield

11.8405%

Price

₹ 1,00,000.00

BERAR FINANCE LIMITED

Coupon

11.2500%

Maturity

Jun 2027

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.5000%

Price

₹ 1,00,628.21

KRAZYBEE SERVICES PRIVATE LIMITED

Coupon

10.4000%

Maturity

Jan 2027

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.5000%

Price

₹ 99,673.42

MANBA FINANCE LIMITED

Coupon

11.3000%

Maturity

Jun 2027

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.5000%

Price

₹ 10,056.10

NAMRA FINANCE LIMITED

Coupon

11.0000%

Maturity

May 2026

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.4490%

Price

₹ 1,02,169.86

EARLYSALARY SERVICES PRIVATE LIMITED

Coupon

10.7000%

Maturity

Mar 2027

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.2500%

Price

₹ 1,00,132.98

NAVI FINSERV LIMITED

Coupon

10.0000%

Maturity

Mar 2027

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.2000%

Price

₹ 99,280.37

KOSAMATTAM FINANCE LIMITED

Coupon

10.6200%

Maturity

Jul 2027

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.2000%

Price

₹ 99,780.42

Note:

The listing of products above should not be considered an endorsement or recommendation to invest. Please use your own discretion before you transact. The listed products and their price or yield are subject to availability and market cutoff times. Pursuant to the provisions of Section 193 of Income Tax Act, 1961, as amended, with effect from, 1st April 2023, TDS will be deducted @ 10% on any interest payable on any security issued by a company (i.e. securities other than securities issued by the Central Government or a State Government).

Note: The listing of products above should not be considered an endorsement or recommendation to invest. Please use your own discretion before you transact. The listed products and their price or yield are subject to availability and market cutoff times. Pursuant to the provisions of Section 193 of Income Tax Act, 1961, as amended, with effect from, 1st April 2023, TDS will be deducted @ 10% on any interest payable on any security issued by a company (i.e. securities other than securities issued by the Central Government or a State Government).