What are 54EC Bonds or Capital Gain Bonds

What are 54EC Bonds or Capital Gain Bonds

54EC or Capital Gain Bonds are investments in bonds that help you save tax. Capital Gain Bonds have been designed specifically to encourage people to invest in long-term infrastructure projects led by government-owned PSUs and in return offer investors a tax saving mechanism. The name is derived from Section 54EC of the Income Tax Act of 1961, under which investors can claim tax exemption on capital gains.

What is Capital Gains Tax?

Capital Gain is an economic concept defined as the profit earned on the sale of a capital asset (eg. Land/Building) that has been held over a period of time. The profit or gain arises when the sale price of the asset is higher than the purchase price and is calculated as the difference between the two. Investors must pay taxes in the year the capital asset is transferred which is called Capital Gains Tax.

Capital gains tax is applied only to profits earned from the capital asset sale, but not on inheritance or gift, regardless of the ownership transfer.

Eligibility for 54EC Bonds

To invest in 54EC bonds, you must meet the following eligibility criteria:

- Individuals, Hindu Undivided Families (HUFs), companies, and trusts can invest in these bonds.

- Only capital gains from property sales comprising land and buildings, both residential and commercial, are considered for tax exemption.

- Investors must reinvest their long-term capital gains within six months of the asset transfer.

- The maximum investment limit is ₹50 lakhs in a financial year.

Understanding 54EC bonds eligibility ensures that taxpayers can maximize their capital gains tax savings through these instruments.

Tax Exemption Under 54EC Bonds

By investing in capital gain tax saving bonds, you can claim exemptions under Section 54EC of the Income Tax Act 1961. Key details include:

- Tax exemption applies only to long-term capital gains.

- Investment in 54EC bonds have a lock-in of 5 years from the date of investment. Investors can’t sell or redeem the bonds for five years to avail the tax exemption.

- No interest earned from these bonds is tax-free; only the capital gain reinvestment qualifies for exemption.

These bonds serve as an excellent option for reducing tax liability while contributing to nation-building.

Issuers of 54EC or Capital Gain Bonds

Only certain Public Sector Undertakings (PSUs) are approved by the government to issue 54EC Bonds. The benefit to investors is that these issuers are government owned hence all the bonds are rated AAA (highest safety) by credit rating agencies and carry minimal risk. The following are eligible to issue Capital Gain Bonds:

REC – Rural Electrification Corporation Limited (REC 54EC Bonds)

PFC – Power Finance Corporation Limited

IRFC – Indian Railways Finance Corporation Limited

Click here to see the entire list of 54EC bonds for investment on IndiaBonds.Key features of 54EC Bonds

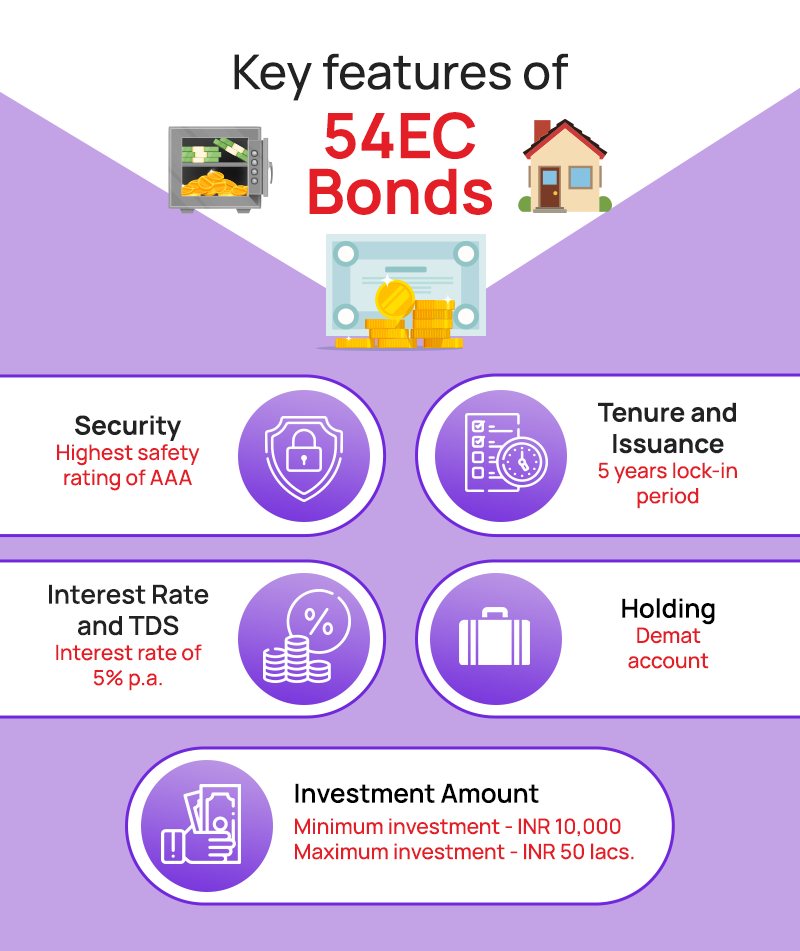

In India, these bonds are a popular investment choice for mitigating long-term capital gains tax arising out of the sale of the property. Here are the main features of the bonds:

- Security – 54EC Bonds are a safe and secure investment as they are issued by government-owned PSUs and carry the highest safety rating of AAA

- Tenure and Issuance – These bonds have maturity or tenure of 5 years from the date of issue. The issuance date is from the date of receipt of your application itself. Bonds have a lock-in period of 5 years and are automatically redeemed at par at maturity

- 54EC bonds interest rates and TDS – These bonds have an interest rate of 5.25% per annum currently which is payable annually.

There is no TDS deduction applied on the interest rate. However, investors have to pay tax on the interest as per their own applicable slab rate under interest income for that year.

- Investment Amount– Minimum investment in Capital Gain Bonds is 1 bond for INR 10,000 with a maximum limit in a financial year of up to 500 bonds for INR 50 lacs.

- Holding– These bonds can be held easily in your Demat account or in physical form. We always recommend investors hold securities in Demat accounts given higher safety and convenience!

Advantages of Capital Gain Bonds or 54EC Bonds

- Tax Saving: Investors can save taxes on long-term capital gains from property sale.

- Secure: Backed by government organizations, these bonds are considered safe as they carry the highest safety rating.

- Convenient Investment: Easily accessible through authorized agencies like banks, financial institutions and OBPPs like IndiaBonds.

- Promotes Infrastructure: Investments contribute to the development of the country’s infrastructure.

By understanding what is 54EC capital gain bonds and their advantages, taxpayers can align their investments with financial goals.

Disadvantages of Capital Gain Bonds or 54EC Bonds

- Lower Returns: The interest rate on 54EC bonds is generally lower than other investment options.

- Lock-in Period: The 5-year lock-in reduces liquidity for investors.

- Maximum Limit: Investments are capped at ₹50 lakhs, restricting high-value capital gains reinvestment.

- Non-Tradable: These bonds cannot be traded or transferred in the secondary market.

While these bonds are excellent for tax-saving purposes, their limitations may not suit all investors’ needs.

How to buy 54EC Bonds Online?

This is where IndiaBonds makes it extremely simple for you. We believe that investors in India and an NRI should have access to transparent pricing, information at hand, and the guidance of experts if required. You can invest online by yourself in 54EC Bonds.

If you are unsure of where to begin, contact us, and one of our bond managers will get back to you shortly and guide you through the process.

In this digital age, it is time to explore investment options and buy bonds online from the comfort of your home in India!Update On Budget 2024

In the Union Budget 2024, our honorable Finance Minister announced an increase in capital gains taxes for most investment assets. However, for real estate, the tax rate was reduced from 20% to 12.5% but with the removal of indexation benefit for all homes purchased after 2001. This has serious implications on the LTCG tax levied on the sale of immovable property.

Conclusion

54EC bonds serve as an effective tool for investors seeking to mitigate long-term capital gains tax arising from the sale of immovable property. By offering a government-backed, low-risk investment avenue with tax exemption benefits, they cater to risk-averse investors aiming for capital preservation. However, potential investors should carefully evaluate the lock-in period, interest rates, and tax implications on interest income. Consulting with financial advisors can provide personalized insights, ensuring that investing in 54EC bonds aligns with individual financial goals and tax planning strategies.

FAQs

Q. What is the maximum amount I can invest in 54EC bonds?

A. You can invest up to ₹50 lakhs in a financial year in capital gain tax saving bonds.

Q. Can NRIs invest in 54EC bonds?

A. Yes, NRIs can invest in these bonds, provided they meet the eligibility criteria and comply with FEMA guidelines.

Q. Are the interest earnings on 54EC bonds taxable?

A. Yes, the interest earned is taxable, but the capital gains reinvested in these bonds qualify for exemption under Section 54EC.

Q. What is the lock-in period for 54EC bonds?

A. The lock-in period is 5 years, during which the bonds cannot be sold or transferred or use as collateral for loans.

Q. Where can I buy 54EC bonds?

A. These bonds can be purchased through authorized distributors, including banks, financial institutions, and online platforms like IndiaBonds.

Q. Are 54EC bonds risk-free?

A. They carry minimal risk as these bonds are backed by government entities with highest credit rating.

Q. What happens if I sell the bonds before maturity?

A. Selling the bonds before maturity violates the conditions of Section 54EC, and the tax exemption claimed will be revoked.

Q. Can Section 54EC be availed multiple times for the same property?

A. Yes, the exemption under Section 54EC can be availed multiple times for the same property, provided it does not exceed the overall limit of ₹50 lakhs in a financial year.

Disclaimer: Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.