ARKA FINCAP LIMITED

Sector Focus

Diversified NBFC

Highest Credit Rating

AA (Stable) by CRISIL RATINGS LIMITED

Jan 06, 2024

Yield

Request for Quote

Coupon

9.6500 % p.a

Rating

AA (Stable)

ISIN

INE03W107249

Maturity Date

27 Dec, 2026

Key Strengths

Strategic importance to, and expectation of strong support from Kirloskar Oil Engines Limited (KOEL)

Arka derives strong support from its ultimate parent, KOEL , in the form of high strategic importance and strong moral obligations, being its step-down subsidiary. The financial services entity has been identified as a focus area for the parent’s overall diversification plans. KOEL has already infused around Rs 930 crores till date (Rs 125 crore and Rs 130 crore were infused in fiscal 2021 and fiscal 2022 respectively; Rs 149 crore were infused in fiscal 2023 till date), depicting strong financial support towards its subsidiary

Adequate capitalisation for initial stages of operations

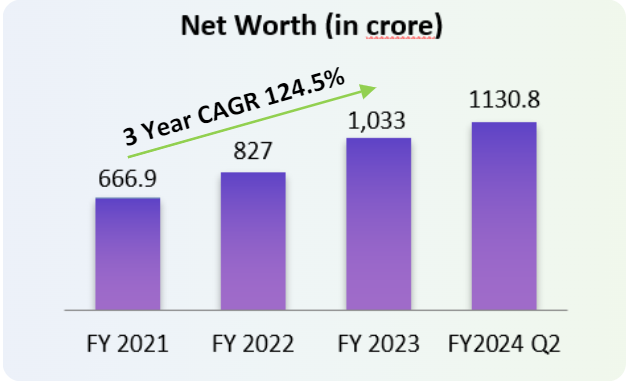

Arka benefits from funding support from the ultimate parent and has adequate capitalisation for initial stages of operations. KOEL has already infused around Rs. 930 crore till date. Capital support from the parent, is expected to keep capitalisation of Arka adequate (Net worth of Rs 1,036 crore and Capital Adequacy ratio of 29.8% as on December 31, 2022 and Rs 837 crore and 30.9% as on March 31, 2022), with low gearing of 2.4 times as on December 31, 2022 (2.1 times as on March 31, 2022) in the initial stages of operation

Bonds you may like...

VARTHANA FINANCE PRIVATE LIMITED

Coupon

11.3500%

Maturity

Sep 2027

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

12.1300%

Price

₹ 1,01,567.75

KRAZYBEE SERVICES PRIVATE LIMITED

Coupon

10.9500%

Maturity

Jul 2026

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

12.0000%

Price

₹ 99,714.80

MANBA FINANCE LIMITED

Coupon

11.3500%

Maturity

Oct 2026

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.9594%

Price

₹ 9,996.89

NAMRA FINANCE LIMITED

Coupon

11.0000%

Maturity

May 2026

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.4602%

Price

₹ 1,00,060.27

NAVI FINSERV LIMITED

Coupon

10.6000%

Maturity

May 2027

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.4000%

Price

₹ 9,970.96

NAVI FINSERV LIMITED

Coupon

10.4800%

Maturity

Jun 2026

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.1500%

Price

₹ 10,012.29

NAVI FINSERV LIMITED

Coupon

10.6000%

Maturity

Sep 2026

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.0500%

Price

₹ 10,055.15

AYE FINANCE LIMITED

Coupon

10.1000%

Maturity

Mar 2027

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.0000%

Price

₹ 99,522.44

Note:

The listing of products above should not be considered an endorsement or recommendation to invest. Please use your own discretion before you transact. The listed products and their price or yield are subject to availability and market cutoff times. Pursuant to the provisions of Section 193 of Income Tax Act, 1961, as amended, with effect from, 1st April 2023, TDS will be deducted @ 10% on any interest payable on any security issued by a company (i.e. securities other than securities issued by the Central Government or a State Government).

Note: The listing of products above should not be considered an endorsement or recommendation to invest. Please use your own discretion before you transact. The listed products and their price or yield are subject to availability and market cutoff times. Pursuant to the provisions of Section 193 of Income Tax Act, 1961, as amended, with effect from, 1st April 2023, TDS will be deducted @ 10% on any interest payable on any security issued by a company (i.e. securities other than securities issued by the Central Government or a State Government).