SATYA MICROCAPITAL LIMITED

Sector Focus

Diversified NBFC

Highest Credit Rating

BBB+ (Stable) by CRISIL RATINGS LIMITED

Feb 13, 2024

Yield

Request for Quote

Coupon

13.8500 % p.a

Rating

BBB+ (Stable)

ISIN

INE982X08109

Maturity Date

12 Jul, 2029

Key Strengths

Experienced Promoter and Management Team

Promoter & MD , Mr. Vivek Tiwari has over two decades of experience in the microfinance and development sector. Prior to SML, he had worked with Satin Credit Care for 8 years

Marquee Institutional Investor, Gojo & Company Inc. based out of Japan, is a world leader in Microfinance, promoting financial inclusion with operations in Myanmar, Sri Lanka, Tajikistan and Cambodia

SML’s management team members has experience of over 15 years in their functional domains with specialization in the microfinance sector

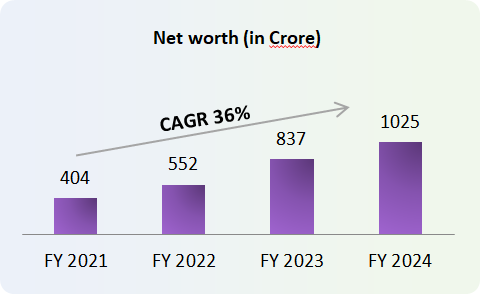

Improving Earnings Profile and Net Worth with sustainable practices

SML reported a PAT of Rs 53 crore as of 31st March 23 vs. a PAT of Rs 32 crore as on 31st March 22

The Net Worth stands at Rs 837 crore at the end of FY 2023 achieving a CAGR of 44% as compared to Rs 404 at the end of FY 2021

Assets Under Management as on 31st March 23 was at Rs 4684 Crore showing a CAGR of 78% in the last 3 years

As per CRISIL Ratings, 100% disbursements done by SML are Cashless

Bonds you may like...

ESAF SMALL FINANCE BANK LIMITED

Coupon

11.3000%

Maturity

May 2031

Rating

Type of Bond

Subordinate Debt Tier 2 - Lower

Yield

12.2500%

Price

₹ 99,535.57

KRAZYBEE SERVICES LIMITED

Coupon

10.6500%

Maturity

Aug 2027

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.7500%

Price

₹ 99,568.22

MANBA FINANCE LIMITED

Coupon

10.9500%

Maturity

Oct 2027

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.6000%

Price

₹ 1,00,015.50

KOSAMATTAM FINANCE LIMITED

Coupon

10.6200%

Maturity

Feb 2028

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.5500%

Price

₹ 98,904.25

EARLYSALARY SERVICES PRIVATE LIMITED

Coupon

10.7000%

Maturity

Mar 2027

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.5000%

Price

₹ 99,404.25

NAVI FINSERV LIMITED

Coupon

10.3000%

Maturity

Sep 2027

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.3000%

Price

₹ 9,957.25

AYE FINANCE LIMITED

Coupon

10.3500%

Maturity

Dec 2027

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.0000%

Price

₹ 99,880.18

AYE FINANCE LIMITED

Coupon

10.2500%

Maturity

Jun 2027

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.0000%

Price

₹ 99,489.39

Note:

The listing of products above should not be considered an endorsement or recommendation to invest. Please use your own discretion before you transact. The listed products and their price or yield are subject to availability and market cutoff times. Pursuant to the provisions of Section 193 of Income Tax Act, 1961, as amended, with effect from, 1st April 2023, TDS will be deducted @ 10% on any interest payable on any security issued by a company (i.e. securities other than securities issued by the Central Government or a State Government).

Note: The listing of products above should not be considered an endorsement or recommendation to invest. Please use your own discretion before you transact. The listed products and their price or yield are subject to availability and market cutoff times. Pursuant to the provisions of Section 193 of Income Tax Act, 1961, as amended, with effect from, 1st April 2023, TDS will be deducted @ 10% on any interest payable on any security issued by a company (i.e. securities other than securities issued by the Central Government or a State Government).