TYGER CAPITAL PRIVATE LIMITED

Sector Focus

MSME

Highest Credit Rating

A+ (Stable) by CRISIL RATINGS LIMITED

Jan 06, 2025

Yield

9.7500% XIRR

Coupon

9.9000 % p.a

Rating

A+ (Stable)

ISIN

INE01EQ07137

Call Date

13 Feb, 2026

Key Strengths

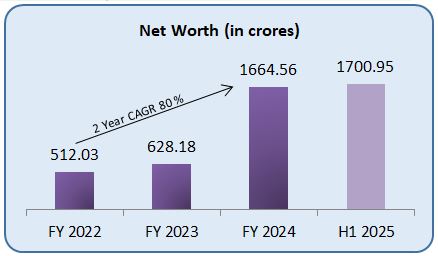

Comfortable capitalisation

Tyger Capital Private Limited (TCPL) benefits from financial flexibility due to Bain

Capital's ownership. In July 2023, Bain Capital (AUM: $18,000 crore USD) invested in TCPL through BCC Atlantis II

Pte Ltd, a Singapore-based entity. Bain holds a 93% stake in TCPL, its first controlling stake in India’s financial

services sector

Adequate asset quality metrics

TCPL maintains adequate asset quality metrics, with GNPA at 2.0% and 2.3% as

of March 31, 2024, and September 30, 2024, supported by a moderate operational track record

Experienced management

Bain Capital has appointed three directors to TCPL’s Board. The group’s experienced

management team has successfully scaled operations in housing and non-housing finance, leveraging extensive

expertise and a proven track record in the financial services sector

Diversified lending portfolio

TCPL’s lending business is well-diversified across retail-focused asset classes. As of

September 30, 2024, the portfolio included business loans (33% of AUM), farm sector finance (28%), commercial

vehicle loans (11%), home loans (17%), loan against property (7%), and supply chain finance (4%)

Bonds you may like...

VARTHANA FINANCE PRIVATE LIMITED

Coupon

11.3500%

Maturity

Sep 2027

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

12.1300%

Price

₹ 1,01,567.75

KRAZYBEE SERVICES PRIVATE LIMITED

Coupon

10.9500%

Maturity

Jul 2026

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

12.0000%

Price

₹ 99,714.80

MANBA FINANCE LIMITED

Coupon

11.3500%

Maturity

Oct 2026

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.9594%

Price

₹ 9,996.89

NAMRA FINANCE LIMITED

Coupon

11.0000%

Maturity

May 2026

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.4602%

Price

₹ 1,00,060.27

NAVI FINSERV LIMITED

Coupon

10.6000%

Maturity

May 2027

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.4000%

Price

₹ 9,970.96

NAVI FINSERV LIMITED

Coupon

10.4800%

Maturity

Jun 2026

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.1500%

Price

₹ 10,012.29

NAVI FINSERV LIMITED

Coupon

10.6000%

Maturity

Sep 2026

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.0500%

Price

₹ 10,055.15

AYE FINANCE LIMITED

Coupon

10.1000%

Maturity

Mar 2027

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.0000%

Price

₹ 99,522.44

Note:

The listing of products above should not be considered an endorsement or recommendation to invest. Please use your own discretion before you transact. The listed products and their price or yield are subject to availability and market cutoff times. Pursuant to the provisions of Section 193 of Income Tax Act, 1961, as amended, with effect from, 1st April 2023, TDS will be deducted @ 10% on any interest payable on any security issued by a company (i.e. securities other than securities issued by the Central Government or a State Government).

Note: The listing of products above should not be considered an endorsement or recommendation to invest. Please use your own discretion before you transact. The listed products and their price or yield are subject to availability and market cutoff times. Pursuant to the provisions of Section 193 of Income Tax Act, 1961, as amended, with effect from, 1st April 2023, TDS will be deducted @ 10% on any interest payable on any security issued by a company (i.e. securities other than securities issued by the Central Government or a State Government).