Aug’ 2025 Monetary Policy Highlights and Rationale

The RBI’s Monetary Policy Committee (MPC) conducted its monetary policy meeting from August 4-6, 2025.

On the basis of an assessment of the evolving macroeconomic situation, the Monetary Policy Committee (MPC) made the following announcements:

MPC unanimously decided to keep Repo rate unchanged at 5.50%, consequently the standing deposit facility (SDF) stands at 5.25%.

- Accordingly, the Marginal Standing Facility (MSF) rate and the Bank Rate stand at 5.75%.

- The reverse repo rate under the LAF stands unchanged at 3.35%.

- The MPC also decided unanimously to keep the stance unchanged to neutral.

Part A: RBI’s Policy decision Rationale:

1. Inflation

CPI headline inflation fell for the eighth consecutive month, reaching a 77-month low of 2.1% in Jun’25. This decline was largely driven by a significant reduction in food inflation, supported by improved agricultural output. Notably, food inflation turned negative for the first time since Feb’19, registering at -0.2% in Jun’25, with double-digit deflation observed in vegetables and pulses contributing to this contraction. Core inflation has remained stable around 4 percent, as expected. It stayed within a narrow range of 4.1–4.2% from Feb’25-May’25, before rising to 4.4% in Jun’25, partly due to the continued increase in gold prices.

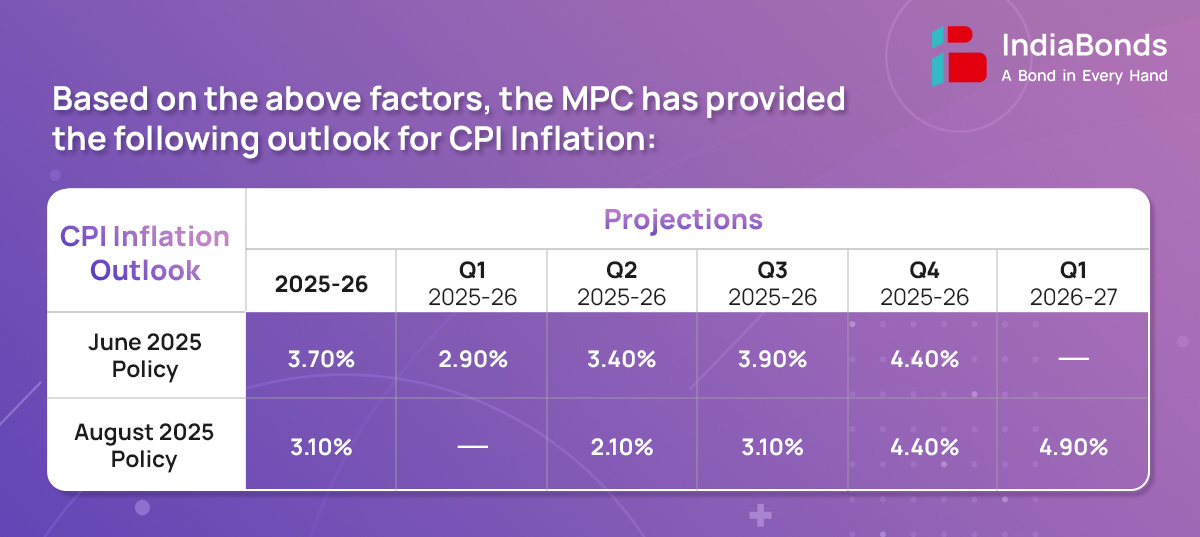

The MPC expects CPI outlook to be shaped by several factors such as:

- The inflation outlook for FY26 has improved, supported by favorable base effects, steady southwest monsoon progress, healthy kharif sowing, adequate reservoir levels, and ample food grain buffer stocks.

- Despite the moderation, CPI inflation is expected to rise above 4% in Q4 of 2025-26 and beyond, influenced by unfavorable base effects and demand-side pressures from policy measures.

- Core inflation is likely to remain moderately above 4% throughout the year, assuming no major negative shocks to input prices. Weather-related shocks continue to pose a significant risk to the inflation outlook.

- Assuming a normal monsoon, the CPI inflation for the FY26 is projected at 3.7% with Q2 at 3.4%, Q3 at 3.8% and Q4 at 4.4%.

2. Growth

Domestic growth remains broadly in line with expectations despite mixed high-frequency signals in May-Jun’25. Rural consumption continues to be resilient, while urban consumption, particularly discretionary spending, shows only a tepid revival. Fixed investment, driven by strong government capital expenditure, supports economic activity. The steady southwest monsoon has aided kharif sowing, reservoir replenishment, and agricultural output. Services sector activity is stable, with the Services PMI reaching an 11-month high of 60.5 in Jul’25. Manufacturing PMI remains strong, though the IIP growth has subdued with electricity & mining sectors lagging. External demand prospects are uncertain due to tariffs, geopolitical tensions, and global uncertainties.

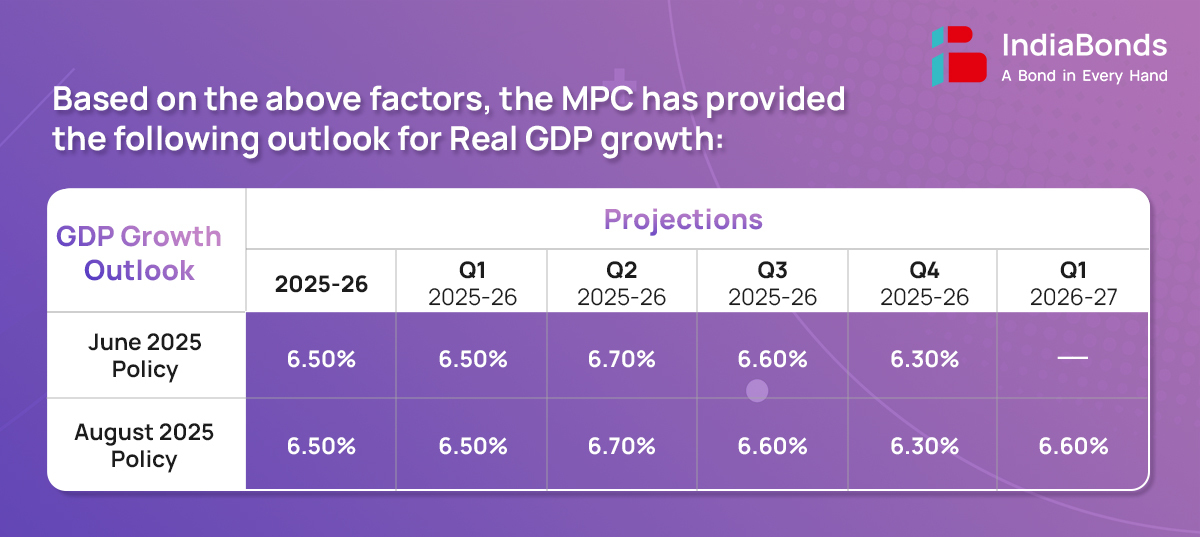

The MPC expects real GDP to be based on the following factors:

- The above normal southwest monsoon, lower inflation, rising capacity utilization and congenial financial conditions continue to support domestic economic activity.

- The supportive monetary, regulatory and fiscal policies including robust government capital expenditure should also boost demand. The services sector is expected to remain buoyant, with sustained growth in construction and trade in the coming months.

- Prospects of external demand, however, remain uncertain amidst ongoing tariff announcements and trade negotiations. The headwinds emanating from prolonged geopolitical tensions, persisting global uncertainties, and volatility in global financial markets pose risks to the growth outlook.

- Taking all these factors into account, real GDP growth for FY25-26 is projected at 6.50%, with Q1 at 6.50%, Q2 at 6.70%, Q3 at 6.60% and Q4 at 6.30%.

3. Liquidity

- System liquidity has been in surplus, on an average of Rs. 3 lakh crore per day since the last MPC, as compared to an average of Rs. 1.6 lakh crore during the last 2 months. Going ahead, CRR cut announced in last MPC will comes into effect from September, will further ease liquidity conditions.

- Comfortable liquidity in the banking system has enhanced transmission of policy repo rate cuts to money, bond, and credit markets. From Feb’25-Jun’25, scheduled commercial banks’ weighted average lending rates declined by 71 bps for fresh loans and deposit rates moderated by 87 bps.

- An internal working group has recommended continuation of overnight WACR as the main monetary policy target, continuing variable rate auctions for repo and reverse repo operations. The WACR is highly correlated with TREPS and Market Repo.

- Going forward, The RBI will continue to manage liquidity with, ensuring sufficient banking system funds to meet economic needs.

4. Global Economy

The global environment continues to be challenging. Although financial market volatility and geopolitical uncertainties have abated somewhat from their peaks in recent months, trade negotiation challenges continue to linger. Global growth, though revised upwards by the IMF, remains muted. The pace of disinflation is slowing down, with some advanced economies even witnessing an uptick in inflation.

Part B: Other Announcements:

1. Auto-bidding for T-Bills on RBI Retail Direct

RBI has enabled an auto-bidding facility for Treasury bills (T-bills), covering both investment and re-investment options in Retail Direct. The new functionality helps investors to mandate automatic placement of bids in primary auctions of T-bills.

2. Standardization of documentation for Settlement of Deceased Depositors’ Claims

RBI has proposed to streamline the procedures and standardise the documentation to be submitted to the banks. Nomination facility is available in respect of deposit accounts, articles kept in safe deposit lockers. This will expedite settlement of claims or return of articles or release of contents of safe deposit locker upon death of a customer.

The next meeting of the MPC is scheduled from September 29 to October 1, 2025.

Disclaimer: Investments in debt securities/ municipal debt securities/ securitized debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.