December 2024 – RBI Monetary Policy Highlights

The RBI’s Monetary Policy Committee (MPC) conducted its monetary policy meeting from December 4-6, 2024.

On the basis of an assessment of the evolving macroeconomic situation, the Monetary Policy Committee (MPC) made the following announcements:

Keep the policy repo rate unchanged at 6.50% by a majority of 4 out of 6, consequently the standing deposit facility is unchanged at 6.25%.

Accordingly, the Marginal Standing Facility (MSF) rate and the Bank Rate remain unchanged at 6.75%.

The reverse repo rate under the LAF stands unchanged at 3.35%.

The CRR has been reduced to 4.00% of NDTL from 4.5% in two equal tranches of 25 bps.

The MPC has unanimously maintained its ‘neutral stance’ and remain unambiguously focused on a durable alignment of inflation with the target, while supporting growth.

Part A: RBI’s Policy decision Rationale:

1. Inflation

CPI headline inflation surged in Sept’24 and Oct’24 driven by an unexpected rise in food prices, which contributed 74% to the headline inflation in Oct’24. Core inflation also saw an uptick in Oct, reaching 3.80% year-on-year, largely due to higher prices in housing and personal care & effects. Meanwhile, the fuel group continued to experience deflation for the 14th consecutive month in October.

The MPC expects CPI outlook to be shaped by several factors such as:

Healthy Kharif crop production, higher reservoir levels, adequate soil moisture, and improved Rabi sowing are expected to help ease food inflation pressures.

The rising trend in domestic edible oil prices, driven by an increase in import duties and higher global price, requires close monitoring.

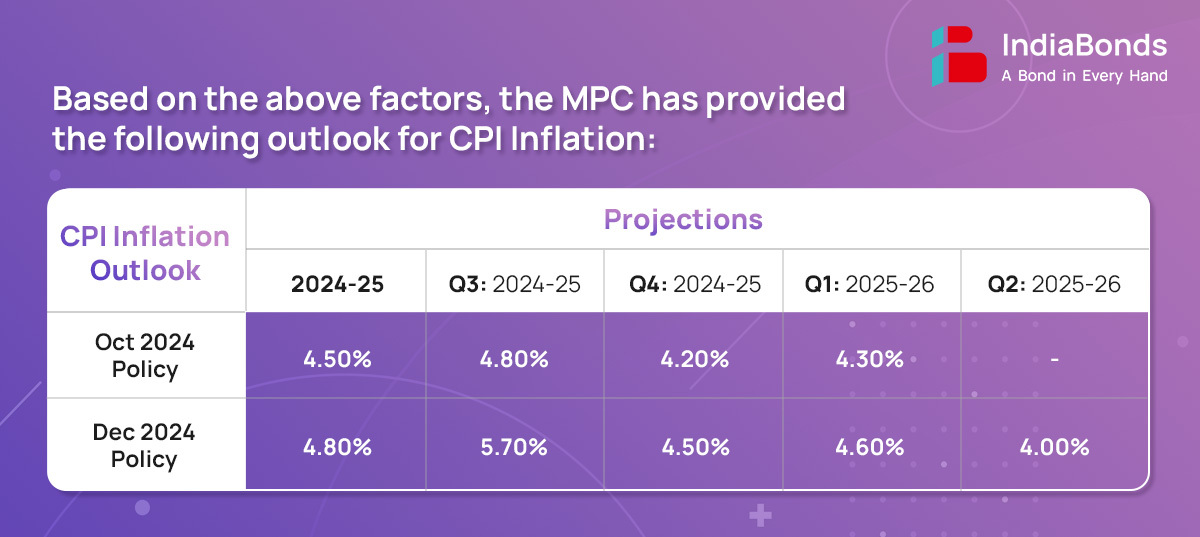

Given current conditions, CPI inflation for FY24-25 is projected to be 4.80%, with Q3 at 5.70%, Q4 at 4.50%, and for FY25-26, Q1 at 4.60% and Q2 at 4.00%.

2. Growth

The real GDP growth in Q2 FY25 was 5.4%, much lower than expectations, and the GVA figures were similarly disappointing, at 5.6% in Q2 FY25 against 6.8% in Q1 FY25. This decline in growth was primarily driven by a sharp slowdown in industrial growth, which fell from 7.4% in Q1 FY25 to 2.1% in Q2 FY25. Other factors included weak performance in manufacturing, a contraction in mining activity, and reduced electricity demand (due to excessive rainfall). However, the manufacturing sector’s weakness was not broad-based and was concentrated in specific industries, such as petroleum products, iron and steel (due to oversupply from China), and cement.

The MPC expects real GDP to be based on the following factors:

Strong festive demand and increased rural activity are expected to support a recovery in domestic economic activity.

The expansion in government capital expenditure, together with rising output in core industries (3.1%), is projected to help normalize overall industrial activity.

Additionally, improved government consumption (+47.1% in October) and increased investment activity are likely to further boost the economy.

Taking all these factors into account, real GDP growth for FY24-25 is projected at 6.60%, with Q3 at 6.80%, Q4 at 7.20%, and for FY25-26, Q1 at 6.90% and Q2 at 7.30%.

3. Liquidity

In order to ease liquidity stress, RBI has decided to reduce the cash reserve ratio (CRR) to 4.0% of NDTL from 4.5% in two equal tranches of 25 bps each with effect from 14th and 28 December 2024.

System liquidity remained in surplus during October-November (Rs. 1.5 lakh crore) on account of higher government spending.

The Reserve Bank mopped up surplus liquidity (Rs.1 1.7 lakh crore) through variable rate reverse repo (VRRR) auctions during October-November, while injected liquidity (Rs.1.25 lakh crore) via variable rate repo (VRR) operations.

Going forward, RBI will remain nimble and flexible in its liquidity management operations to ensure that money market interest rates evolve in an orderly manner.

4. Global Economy

The global economy has shown resilience in 2024, despite facing several headwinds. Inflation is gradually moving towards target levels after reaching multi-decade highs, prompting central banks to begin adjusting their policies. Global trade has also remained robust. However, financial markets have remained uncertain, driven by a strengthening US dollar and rising bond yields, leading to significant capital outflows from emerging markets and increased volatility in equity markets.

Part B: Key Statements on Developmental and Regulatory Policies:

1. Interest Rates on FCNR(B) Deposits

RBI has increased the interest rate ceilings on FCNR(B) deposits. Banks can offer rates up to Alternative Reference Rate (ARR) + 400 bps for deposits of 1-3 years and ARR + 500 bps for deposits of 3-5 years. This change aims to enhance the appeal of FCNR (B) deposits and will be in effect until 31st Mar’25.

2. Expanding reach of FX-Retail Platform through linkages with Bharat Connect

To enhance transparency in foreign exchange pricing, the FX-Retail platform will be linked with Bharat Connect, allowing users to access it via bank apps and non-bank payment providers. A pilot will start with US dollar purchases by individuals and sole proprietors, with plans to expand to other FX transactions.

3. Introduction of the Secured Overnight Rupee Rate – a benchmark based on the secured money markets.

The RBI set up the MIBOR Benchmark Committee to review the use of MIBOR and explore new Rupee interest rate benchmarks. The committee’s report, inviting public comments, recommended measures to enhance the interest rate derivative market and benchmark credibility. In response, the RBI proposes developing the Secured Overnight Rupee Rate (SORR), based on secured money markets.

4. ‘Connect 2 Regulate’ – An Initiative for Open Regulation

The RBI will launch the ‘Connect 2 Regulate’ programme under its RBI@90 events to enhance stakeholder engagement in regulatory processes. A dedicated website section will allow stakeholders to submit ideas and inputs via case studies or concept notes on announced topics.

5. Introduction of Podcast facility as an additional medium of communication.

The RBI plans to launch podcasts as part of its communication strategy to enhance transparency, explain policy decisions, and spread awareness to a broader audience. This initiative builds on its expanding use of public outreach channels, including social media.

6. Collateral-free Agriculture Loan –– Enhancement of Limit

The RBI has increased the limit for collateral-free agriculture loans from Rs. 1.6 lakh to Rs.2 lakh, considering inflation and rising agricultural input costs. This will enhance coverage of small and marginal farmers in the formal credit system.

7. Pre-sanctioned Credit Lines through UPI – Extending the scope to SFBs

In Sep’23, UPI’s scope was expanded to allow pre-sanctioned credit lines via Scheduled Commercial Banks. Now, the RBI proposes Small Finance Banks to offer such credit lines, aiming to provide low-ticket, low-tenor products to ‘new-to-credit’ customers using SFBs’ cost-effective models to reach the last mile.

8. Framework for Responsible and Ethical Enablement of Artificial Intelligence in the Financial Sector

The RBI proposes setting up a committee to develop a Framework for Responsible and Ethical Enablement of AI (FREE-AI) in the financial sector. This framework will address risks like algorithmic bias, data privacy, and decision explain ability while harnessing the transformative potential of AI, ML, and other technologies.

9. AI solutions to identify mule bank accounts – MuleHunter AITM

The RBI is tackling digital fraud by providing cybersecurity guidelines and running a “Zero Financial Frauds” hackathon. It is also piloting the AI/ML-based MuleHunter.AITM model to detect mule accounts, with promising results from a pilot with two public sector banks.

The next meeting of the MPC is scheduled during February 5 to 7, 2024.

Disclaimer: Investments in debt securities/ municipal debt securities/ securitized debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.