June ’2025 Monetary Policy Highlights and Rationale

The RBI’s Monetary Policy Committee (MPC) conducted its monetary policy meeting from June 6-8, 2025.

On the basis of an assessment of the evolving macroeconomic situation, the Monetary Policy Committee (MPC) made the following announcements:

- Reduced the policy repo rate by 50 bps from 6.00% to 5.50%, consequently the standing deposit facility (SDF) is reduced to 5.25%.

- Accordingly, the Marginal Standing Facility (MSF) rate and the Bank Rate changed to 5.75%.

- The reverse repo rate under the LAF stands unchanged at 3.35%.

- The MPC also decided to change the stance from ‘accommodative’ to ‘neutral’.

- A 100 bps cut in the CRR, in four equal tranches of 25 bps each, reducing it to 3.0% from the current 4.0%.

Part A: RBI’s Policy decision Rationale:

1. Inflation

CPI headline inflation saw a significant decline of 45 bps over Mar’25 and Apr’25, falling from 3.6% in Feb’25 to 3.2% in Apr’25. This marks the lowest inflation reading since Jul’19. The primary driver behind this decline was a sharp drop in food inflation, which reached a 42-month low of 2.1% in Apr’25. This reduction in food inflation is largely attributed to a strong seasonal correction in vegetable prices. However, Core inflation saw a marginal uptick, reaching 4.2% y-o-y in Apr’25, after holding steady in Mar’25. This increase in core inflation was primarily driven by a 21.4% surge in gold, a significant contributor in core inflation.

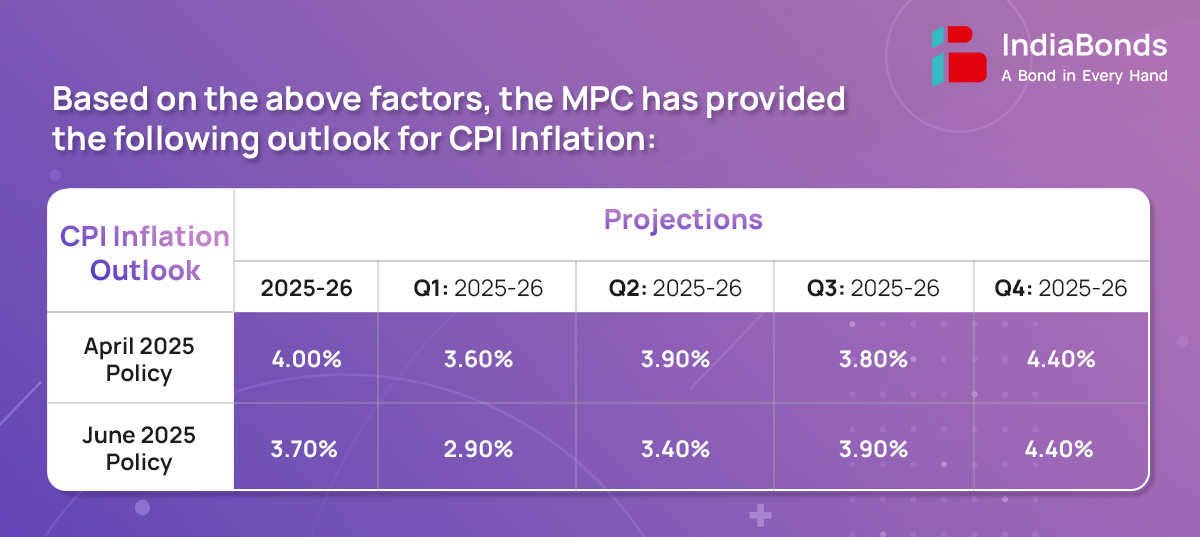

The MPC expects CPI outlook to be shaped by several factors such as:

- Record Rabi season wheat and pulse production, alongside an early above-normal monsoon for Kharif crops, should ensure ample food supply, easing inflation expectations in rural areas.

- Key commodity prices, including crude oil, are anticipated to moderate. However, weather uncertainties evolving tariff concerns present an upside risk to inflation due to their potential impact on global prices.

- Assuming a normal monsoon, the CPI inflation for the FY26 is projected at 3.7% with Q1 at 2.9%, Q2 at 3.4%, Q3 at 3.8% and Q4 at 4.4%.

2. Growth

Domestic economic activity in 2025-26 demonstrates resilience. The agriculture sector remains strong, with ample food supplies from excellent harvests and healthy reservoir levels. Industrial activity is gradually gaining, while the services sector maintains momentum. On the demand side, private consumption and investment are reviving, with robust exports and buoyant imports reflecting strong domestic conditions. Going forward, an above-normal monsoon will boost agriculture and rural demand. Sustained services activity will promote the urban consumption. Trade policy uncertainty weighs on exports, though FTAs offer a trade boost.

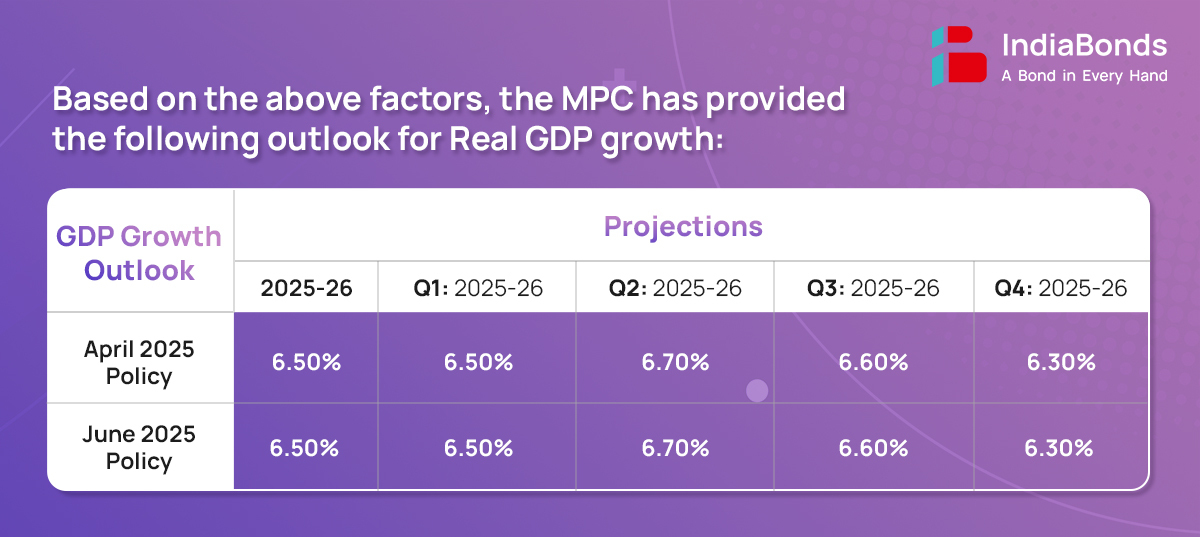

The MPC expects real GDP to be based on the following factors:

- India’s foreign exchange reserves reached US 691.5 billion, sufficient to cover over 11 months of goods imports and 96% of external debt. Overall, the external sector remains resilient, with improving indicators.

- Despite rising geopolitical uncertainties and trade tensions, India’s merchandise trade remained robust, recording a growth of 9.2% in Apr’25. As imports grew faster than exports, trade deficit however widened during the month.

- Healthy balance sheets, government capex, and easing financial conditions will spur investment. Headwinds from global trade disruptions continue to pose downward risks.

- Taking all these factors into account, real GDP growth for FY25-26 is projected at 6.50%, with Q1 at 6.50%, Q2 at 6.70%, Q3 at 6.60% and Q4 at 6.30%.

3. Liquidity

- RBI infused Rs. 9.5 lakh crore liquidity since Jan’25 via open market operations (Rs. 5.2L Cr), VRR auctions (Rs. 2.1 lakh Cr), and USD/INR swaps (Rs. 2.2L Cr). This moved the system from a Dec’24 deficit to a surplus by March end.

- The RBI remains committed to providing sufficient liquidity. It will reduce the Cash Reserve Ratio (CRR) by 100 bps to 3.0% of NDTL from 4% earlier, in 4 equal tranches. This measure will release approximately Rs. 2.5 lakh crore into the banking system by Dec’25.

- Improved liquidity conditions led the WACR to trade at the lower LAF corridor, reinforcing policy repo rate transmission to short-term rates.

- Going forward, RBI will continue to be proactively taking appropriate measures to ensure orderly liquidity conditions.

4. Global Economy

The global backdrop remains fragile and highly fluid. The uncertainty around the global economic outlook has somewhat ebbed since the MPC met in April in the wake of temporary tariff reprieve and optimism around trade negotiations. However, it is still high to weaken sentiments and lower global growth prospects. Accordingly, global growth and trade projections have been revised downwards by multilateral agencies. Moreover, the last mile of disinflation is turning out to be more protracted. As growth-inflation trade-off is becoming more challenging, authorities are charting out a more cautious and carefully calibrated policy trajectory.

The next meeting of the MPC is scheduled during August 4 to 6, 2025.

DISCLAIMER:

Disclaimer: Investments in debt securities/ municipal debt securities/ securitized debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.