October 2025 – RBI Monetary Policy Highlights

The RBI’s Monetary Policy Committee (MPC) conducted its monetary policy meeting from September 29 to October 1, 2025.

On the basis of an assessment of the evolving macroeconomic situation, the Monetary Policy Committee (MPC) made the following announcements:

- MPC unanimously decided to keep Repo rate unchanged at 5.50%, consequently the standing deposit facility (SDF) stands at 5.25%.

- Accordingly, the Marginal Standing Facility (MSF) rate and the Bank Rate stand at 5.75%.

- MPC decided to maintain a neutral stance with 4:2 vote, with two members favoring a shift to an accommodative stance.

Part A: RBI’s Policy decision Rationale:

1. Inflation

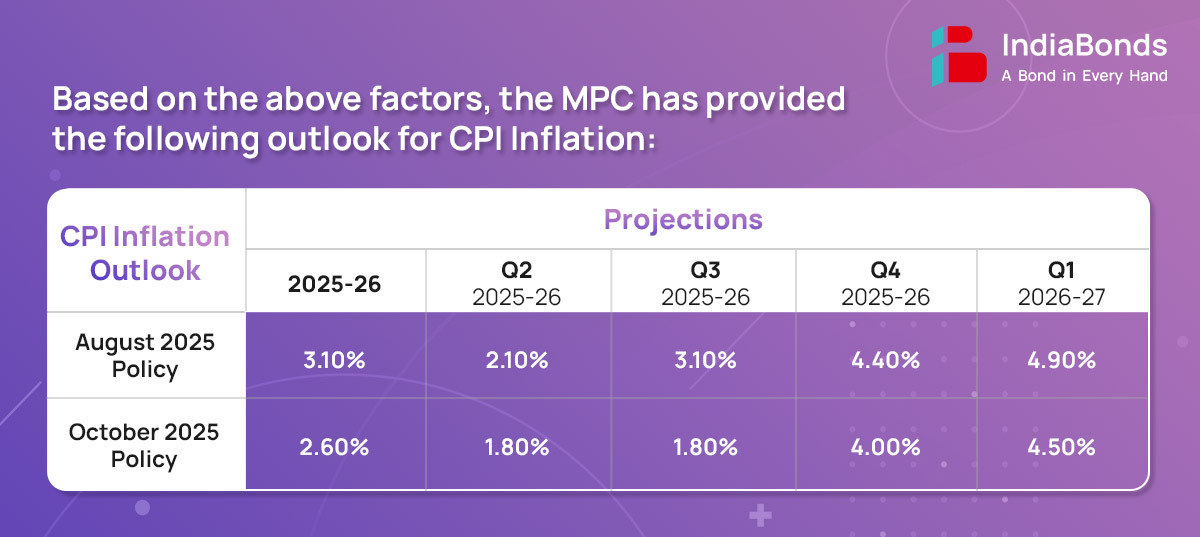

The headline inflation for FY26 has been revised downwards to 2.6% from 3.1% in Aug’25 and 3.7% in Jul’25. Actual inflation outcomes have remained well below earlier projections, reflecting largely subdued price pressures. The decline is primarily driven by a sharp fall in food inflation, supported by improved supply prospects and effective government measures to manage supply chains. Core inflation remained largely contained with the Aug’25 reading at 4.2% despite persistent pressures from precious metals. Projections for headline inflation in Q4 FY26 and Q1 FY27 have also been reduced, remaining broadly aligned with the inflation target despite adverse base effects.

The MPC expects CPI outlook to be shaped by several factors such as:

- Robust kharif sowing, sufficient reservoir storage and adequate buffer stocks of food-grains are expected to keep food prices stable. The advancement of the southwest monsoon has been satisfactory.

- Core inflation is expected to stay slightly above 4% for the year, while weather-related and geopolitical threat remain a key risk to inflation.

- Assuming a normal monsoon, the CPI inflation for the FY26 is projected at 2.6% with Q2 at 1.8%, Q3 at 1.8% and Q4 at 4.0%.

2. Growth

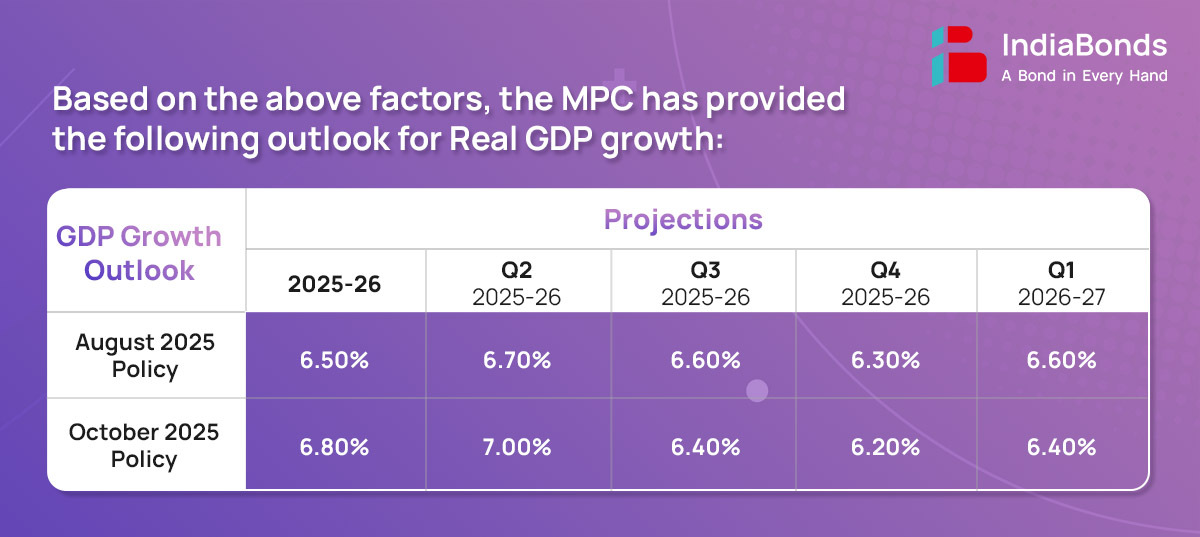

India’s economy grew 7.8% in real GDP and 7.6% in GVA in Q1 FY26, reflecting stronger-than-expected performance. Growth was supported by a favorable monsoon, robust domestic consumption, healthy kharif sowing, and supportive monetary conditions. However, higher U.S. tariffs may moderate exports, posing downside risks. Overall, the growth outlook remains resilient, underpinned by domestic drivers, lower inflation, and continued monetary easing (rationalization of GST cuts), though projections for Q3 onwards are slightly lower due to trade-related headwinds. Bank credit remains healthy, the current account deficit moderated to USD 2.4 billion, net FDI reached a 38-month high, and foreign exchange reserves stood at USD 700.2 billion, covering over 11 months of imports.

The MPC expects real GDP to be based on the following factors:

- Prospects for agriculture and rural demand are further boosted by an above-normal monsoon, strong kharif sowing, and sufficient reservoir levels.

- Strong performance in the services sector, along with consistent employment levels, underpins demand, which is expected to be further reinforced by GST rationalization. Increased capacity utilization, supportive financial conditions, and rising domestic demand should sustain growth in fixed investment

- Ongoing trade and tariff uncertainties could restrain external demand, while extended geopolitical tensions and international market volatility, fueled by cautious investor sentiment, present downside risks to economic growth.

- Taking all these factors into account, real GDP growth for FY226 is projected at 6.80%, with Q2 at 7.00%, Q3 at 7.00%, Q4 at 6.20%.

3. Liquidity

- Since the last MPC meeting in Aug’25, system liquidity measured under the Liquidity Adjustment Facility (LAF) averaged a daily surplus of Rs. 2.1 lakh crore. The upcoming drawdown of government cash balances and the remaining 75-bps cut in the cash reserve ratio during Oct–Nov’25 are expected to support in the near term.

- Following the 100-bps repo rate cut (Feb–Aug’25), weighted average lending rates on fresh loans fell 58 bps and outstanding loans 55 bps, while deposit rates declined 106 bps for fresh and 22 bps for outstanding deposits, with broad-based transmission across sectors.

- The RBI continues to monitor liquidity conditions closely, with prior measures including liquidity infusion of Rs. 5.5 lakh crore via Open Market Operations (OMOs) and a Cash Reserve Ratio (CRR) cut of Rs. 2.5 lakh crore aimed to support credit flow and economic growth.

- Going forward, adequate system liquidty along with the remaining CRR reductions, is expected to facilitate money market rates.

4. Global Economy

The global environment continues to be challenging. Although financial market volatility and geopolitical uncertainties have abated somewhat from their peaks in recent months, trade negotiation challenges continue to linger. Global growth, though revised upwards by the IMF, remains muted. The pace of disinflation is slowing down, with some advanced economies even witnessing an uptick in inflation.

Part B: Other Announcements:

1. Strengthening the resilience and competitiveness of the banking sector

- Basel III – Credit Risk Standardised Approach: Revised Basel III norms, effective 1st April 2027, introduce a Standardised Approach lowering risk weights for MSMEs and residential real estate, enhancing robustness, granularity, and risk sensitivity in capital calculations.

- Expected Credit Loss (ECL) Framework: The ECL framework with prudential floors will apply to all Scheduled Commercial Banks (excluding SFBs, PBs, RRBs) and All India Financial Institutions from 1st April 2027, with a glide path until 31st March 2031, replacing the incurred loss framework while retaining existing asset classification norms.

- Forms of Business and Prudential Regulation for banks: The RBI has proposed in October 2024, the final guidelines remove the proposed restriction on business overlap between banks & their group entities. he circular aims to streamline bank and group entity activities, while providing greater operational flexibility for equity investments and setting up group entities, enhancing autonomy for banks and Non-Operating Financial Holding Companies (NOFHCs).

2. Improving the flow of credit

- Bank Finance for Acquisitions: It is proposed to provide an enabling framework for banks to finance acquisitions by Indian corporates.

- Lending Against Listed Debt Securities: RBI has proposed that Banks’ lending limits will be increased—against shares from Rs, 20 lakh to Rs. 1 crore along with a principle-based framework for lending to capital market intermediaries, and for IPO financing from Rs. 10 lakh to Rs. 25 lakh per person, and the regulatory ceiling on listed debt securities removed.

- Large Borrower Framework: RBI has withdrawn the framework introduced in 2016 that disincentivized lending by banks to specified borrowers (with credit limit from banking system of Rs.10,000 crore and above).

- Risk weight reduction: RBI has proposed to reduce the risk weights applicable to NBFCs for lending to operational and high quality infrastructure projects.

- Investments for Special Rupee Vostro Account: RBI has permitted the use of balances in Special Rupee Vostro Accounts (SRVA) for investment in corporate bonds and commercial papers (CPs).

The next meeting of the MPC is scheduled from December 3-5, 2025.

Disclaimer: Investments in debt securities/ municipal debt securities/ securitized debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.