What are the different types of financial markets?

Introduction

Alright, let’s not complicate things—when people say “financial markets,” they’re not talking about some top-secret place where billionaires hang out in suits. It’s just a fancy term for places (physical or online) where money moves around. That’s it.

It’s where people go to buy and sell stuff like company shares, government bonds, or even currencies. It’s not some elite club. It’s more like the local sabzi mandi… but for money.

What Are Financial Markets?

A financial market is basically where money changes hands. Some people want to invest their extra money. Others need money to run a business, expand their company, or fund big projects. Financial markets are where these two sides meet.

Picture this: You’ve got ₹10,000 lying around. You don’t want to let it sit idle. So you go to the market—maybe you buy a share, or a bond, or even put it in a short-term fund. On the other side, someone gets access to that money to do something useful with it. Win-win.

Understanding the Financial Markets

Now, don’t let the word “market” throw you off. It’s not just one big place. It’s actually a mix of smaller markets—each doing its own thing. Some are slow and steady, others are fast-paced. Some deal in long-term stuff, others are all about quick exchanges.

What they all do is help money move to where it’s needed the most. And they let you grow your savings, take risks, avoid risks, or just park money safely. They’re not mysterious—they’re just tools.

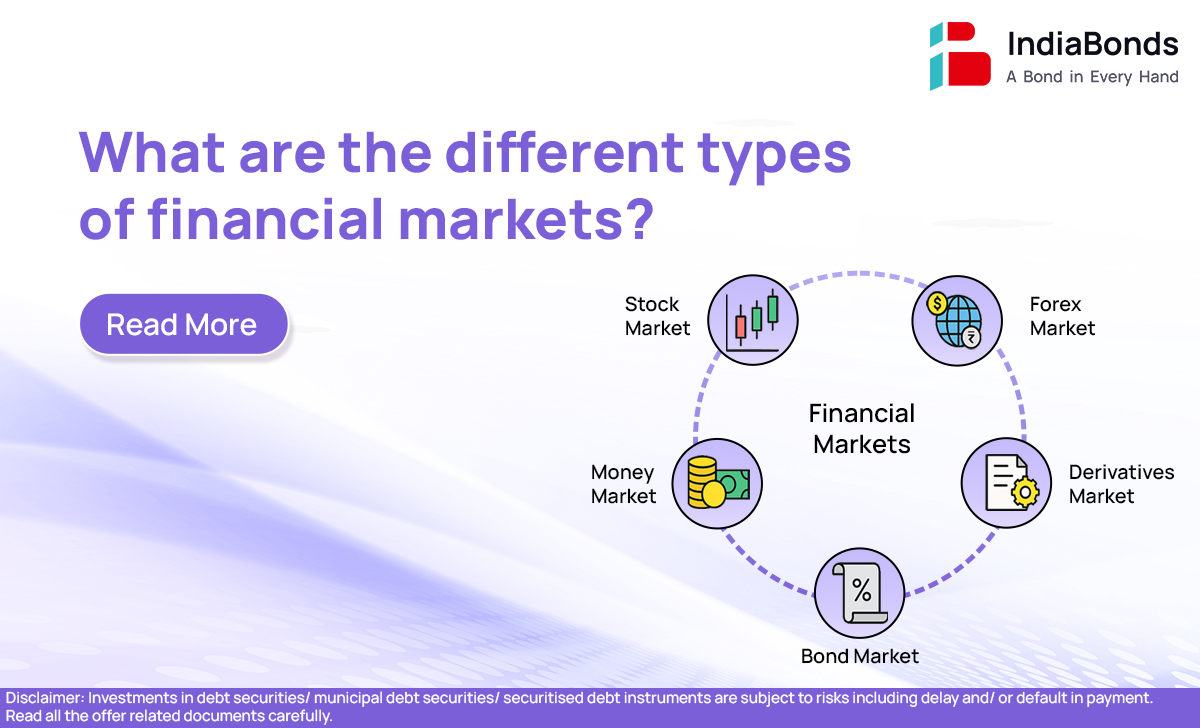

Types of Financial Markets

Let’s talk about the types. Not in finance textbook style, but like how you’d explain it to your cousin who knows nothing about money.

- Stock Market – You’ve probably heard about this one. It’s where people buy ownership in companies. You buy a share, you own a piece of the company. If the company does well, your investment grows.

- Bond Market – Here, you lend money to companies or the government. In return, they promise to pay you back with interest. It’s like being the bank, but without all the paperwork.

- Money Market – Super short-term stuff. Think days, weeks, or a few months. Banks, companies, and institutions use it to handle daily needs. It’s the “quick fix” corner of the financial world.

- Derivatives Market – This one’s more advanced. People trade contracts that depend on things like stock prices or currency rates. Sounds risky (and it is, a bit), but it’s also used to protect against future losses.

- Forex Market – Foreign exchange. Basically, where people buy and sell different currencies. If you’ve ever travelled abroad or ordered something in USD, you’ve brushed past this market.

Each one of these plays a part in keeping the financial system moving. They’re not for the “experts” only. Anyone who saves, invests, or earns money is already a part of it.

Examples of Financial Markets

Still confused? Let’s simplify with some real-world stuff:

- Stock Market: When someone says, “I bought Infosys shares on NSE,” they’re using the stock market.

- Bond Market: You buy a government bond that gives you 7.5% annual interest for 5 years. That’s the bond market in action.

- Money Market: A bank borrows money for one day to meet cash needs. It’s not news, but it happens daily.

- Forex Market: A student sending money to Australia for fees. They convert INR to AUD. That exchange happens through the forex market.

So yeah, you may not have noticed, but you’re already living in a world shaped by financial markets.

Conclusion

Here’s the bottom line: financial markets aren’t some rich-people thing. They’re part of everyday life. Whether you’re saving for your wedding, investing for your child’s future, or planning to retire at 50—these markets are where your money makes things happen.

You don’t need to be a finance pro. Just knowing the basics puts you ahead of most. So the next time someone says “markets are up,” you’ll actually get what they’re talking about—and maybe you’ll even check how your own money is doing.

FAQs

What are the 4 types of financial markets?

They are the stock market, bond market, money market, and derivatives market.

What are the three main financial markets?

Stock, bond, and money markets are usually considered the big three.

Why are there so many different types of financial markets?

Because money works differently in different situations. Some people need quick loans, others want long-term growth. Each market solves a different problem.

What are the 7 major types of financial institutions?

Think: commercial banks, investment banks, insurance companies, NBFCs, mutual funds, pension funds, and cooperative banks. These are the guys who move money around behind the scenes.

Disclaimer : Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.