June’23 RBI Monetary Policy Highlights

The RBI’s Monetary Policy Committee (MPC) conducted its monetary policy meeting from June 6-8, 2023. On the basis of an assessment of the evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting today decided to:

- Keep the policy repo rate unchanged at 6.50% consequently the standing deposit facility is unchanged at 6.25% with immediate effect.

- Accordingly, the marginal standing facility (MSF) rate and the Bank Rate remain unchanged at 6.75%.

- The reverse repo rate under the LAF stands unchanged at 3.35%.

- The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns with the target, while supporting growth.

- These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4% within a band of +/- 2%, while supporting growth.

Part A: RBI’s Policy decision Rationale:

1. Inflation:

CPI inflation fell to 4.7% in April 2023 from 6.4% in February 2023 on the back of large favorable base effects, with softening observed across all the three major groups. Food inflation eased, with moderation in cereals, eggs, milk, fruits, meat and fish, spices and prepared meals inflation and deepening of deflation in edible oils. Inflation in LPG and firewood and chips prices fell and kerosene prices slipped into deflation. Core inflation (i.e., CPI excluding food and fuel) remained below 6% in March’23-April’23. The moderation observed in inflation driven down by clothing and footwear, household goods and services, health, transport and communication, personal care and effects and recreation and amusement.

The MPC expects CPI outlook to be shaped by several factors such as:

- Wheat prices could see some correction on robust Mandis arrivals and procurement. Milk prices, on the other hand, are likely to remain under pressure due to supply shortfalls and high fodder costs the impact of recent unseasonal rains and hailstorms, however, needs to be watched. Milk prices could remain firm due to high input costs and seasonal factors.

- The forecast of a normal south-west monsoon by the India Meteorological Department (IMD) augurs well for Kharif crops; however, the spatial and temporal distribution of the monsoon would need to be closely monitored to assess the prospects for agricultural production.

- Crude oil prices have eased but the outlook remains uncertain.

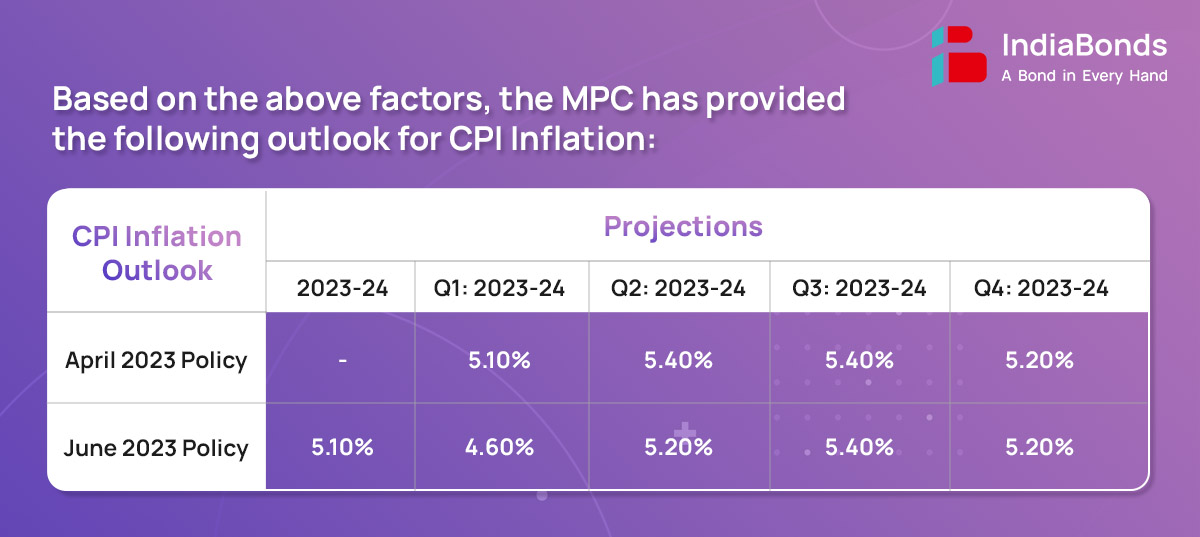

- Taking into account these factors and assuming a normal monsoon, CPI inflation is projected at 5.10% for 2023-24, with Q1 at 4.60%, Q2 at 5.20%, Q3 at 5.40% and Q4 at 5.20%. The risks are evenly balanced.

2. Growth

Domestic economic activity remains resilient in Q1:2023-24 as reflected in high frequency indicators. Purchasing managers’ indices (PMI) for manufacturing and services indicated sustained expansion, with the manufacturing PMI at a 31-month high in May 2023 and services PMI at a 13-year high in April-May. In the services sector, domestic air passenger traffic, e-way bills, toll collections and diesel consumption exhibited buoyancy in April-May, while railway freight and port traffic registered modest growth.

The MPC expects real GDP to be based on the following factors:

- The higher Rabi crop production in 2022-23, the expected normal monsoon, and the sustained buoyancy in services should support private consumption and overall economic activity in the current year.

- The government’s thrust on capital expenditure, moderation in commodity prices and robust credit growth are expected to nurture investment activity.

- Weak external demand, geo-economics fragmentation, and protracted geopolitical tensions, however, pose risks to the outlook.

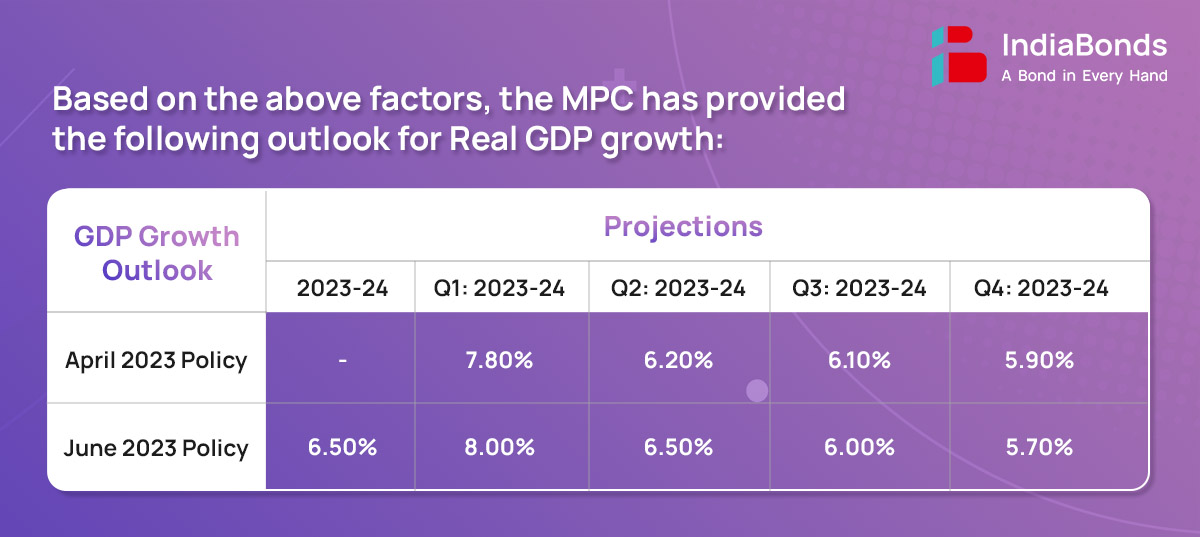

- Taking all these factors into consideration, real GDP growth for 2023-24 is projected at 6.50% with Q1 at 8.00%, Q2 at 6.50%, Q3 at 6.00%, and Q4 at 5.70%, with risks evenly balanced.

3. Liquidity:

- The average daily absorption under the LAF increased to Rs.1.7 lakh crore during April-May from Rs.1.4 lakh crore in February-March.

- During 2022-23, Money supply expanded by 9.0% and non-food bank credit rose by 15.4%.

4. Global Economy:

The global economy is sustaining the momentum gained in the preceding quarter in spite of still elevated though moderating inflation, tighter financial conditions, banking sector stress, and lingering geopolitical conflicts. Sovereign bond yields are trading sideways on expectations of the imminent peaking of the tightening cycle of monetary policy while the US dollar has appreciated. Equity markets have remained range bound since the last MPC meeting. For several emerging market economies (EMEs), weak external demand, elevated debt levels and geo-economics disintegration amidst tighter external financial conditions pose risks to growth prospects, although capital flows are cautiously returning to them on renewed risk appetite.

Part B: Key Statements on Developmental and Regulatory Policies:

1. Borrowing in Call and Notice Money Markets by Scheduled Commercial Banks

In order to provide greater flexibility for managing the money market borrowings, RBI has decided that Scheduled Commercial Banks (ex – Small Finance Banks) can set their own limits for borrowing in Call and Notice Money Markets within the prudential limits for inter-bank liabilities prescribed by the RBI.

2. Widening of the Scope of the Framework for Resolution of Stressed Assets

In order to provide impetus to The Prudential Framework for the Resolution of Stressed Assets, 2019, the RBI has proposed to (i) issue a comprehensive regulatory framework governing compromise settlements and technical write-offs covering all regulated entities; and (ii) rationalize the extant prudential norms for implementation of resolution plans in respect of exposures affected by natural calamities, drawing upon the lessons from the resolution frameworks introduced during the Covid19 pandemic.

3. Default Loss Guarantee Arrangement in Digital Lending

The RBI has decided to issue guidelines on Default Loss Guarantee arrangements in Digital Lending. This will further facilitate orderly development of the digital lending ecosystem and enhance credit penetration in the economy.

4. Priority Sector Lending (PSL) Targets for Primary (Urban) Cooperative Banks (UCBs)

In order to ensure a non-disruptive transition, a glide path was provided till March 31, 2024 to achieve the revised targets. With a view to ease the implementation challenges faced by the UCBs, it has been decided to extend the phase-in time for achievement of the said targets by two years, i.e. up to March 31, 2026. Further, suitable incentives shall be provided to UCBs that have met the prescribed targets as on March 31, 2023.

5. Rationalization of Licensing framework for Authorized Persons (Aps) under Foreign Exchange Management Act (FEMA), 1999

RBI has decided to rationalize and simplify the licensing framework for Authorized Persons (APs) issued under FEMA, 1999 to effectively meet the emerging requirements of the rapidly growing Indian economy. The objective is to achieve operational efficiency in the delivery of foreign exchange facilities to common persons, tourists and businesses, while maintaining appropriate safeguards.

6. Expanding the Scope and Reach of e-RUPI vouchers

The RBI has proposed to expand the scope and reach of e-RUPI vouchers by (a) permitting non-bank Prepaid Payment Instrument (PPI) issuers to issue e-RUPI vouchers and (b) enabling the issuance of e-RUPI vouchers on behalf of individuals. Other aspects like reloading of vouchers, authentication process, issuance limits, etc., will also be modified to facilitate the use of e-RUPI vouchers.

7. Streamlining Bharat Bill Payment System processes and membership criteria

The scope of Bharat Bill Payment System (BBPS) was expanded in Dec’22 to include all categories of payments and collections, both recurring and non-recurring in nature, as well as facilitating in-bound cross-border bill payments. To enhance efficiency of the system and also to encourage greater participation, the process flow of transactions and membership criteria for onboarding operating units in BBPS will be streamlined.

8. Internationalizing Issuance and Acceptance of RuPay Cards

In order to expand payment options for Indians travelling abroad, RBI has decided to allow issuance of RuPay Prepaid Forex cards by banks in India for use at ATMs, PoS machines and online merchants overseas. Further, RuPay Debit, Credit, and Prepaid Cards will be enabled for issuance in foreign jurisdictions, which can be used internationally, including in India.

The next meeting of the MPC is scheduled during 8th – 10th Aug’23

Disclaimer: Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.