Blogs

All

Essential

Insights

Advanced

Investor Caution

Sort by:Latest

>

7 min read

20 Feb, 2026

Essential

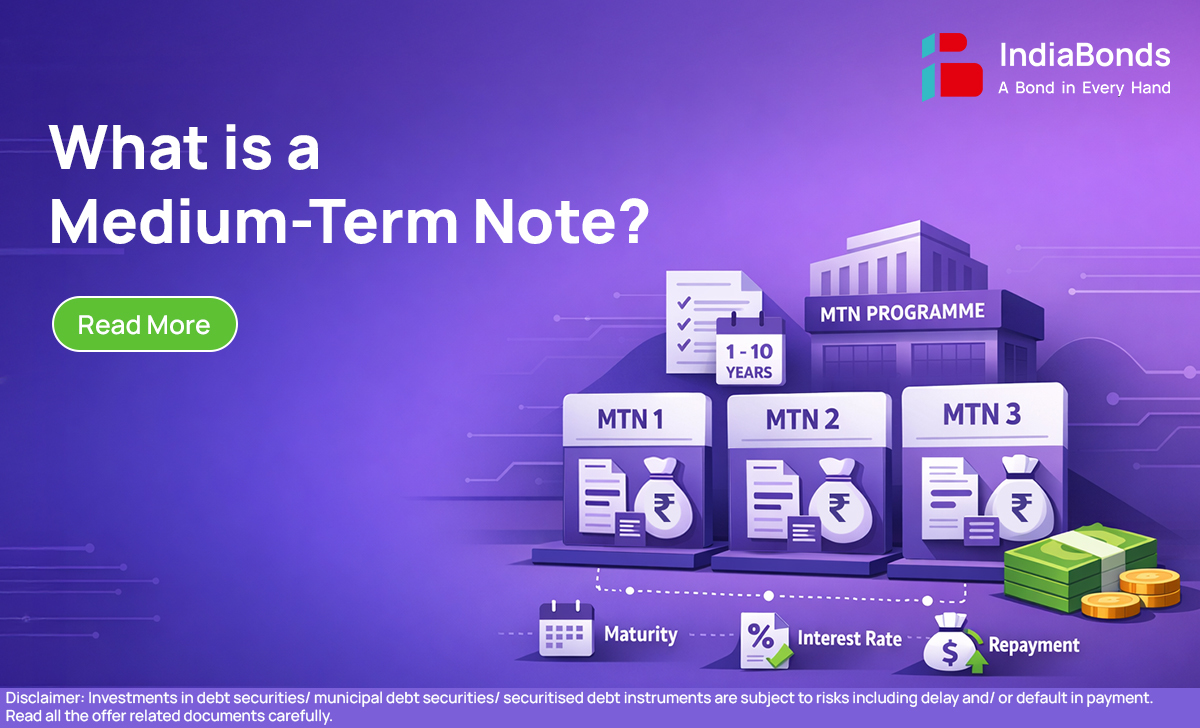

What is a Medium-Term Note

For most people, the debt market feels like a maze of similar-sounding terms. Bonds, notes, debentures—everything seems to mean “someone borrows and someone lends,” so why all the different names? The answer is simple: the market uses different formats because borrowers don’t always need money in the same way, and investors don’t always want to

8 min read

19 Feb, 2026

Essential

What is Greenshoe Option

In most large public offers, there is one line in the offer document that quietly plays a big role in keeping the listing day peaceful: the Greenshoe Option. It does not grab headlines like issue size or listing gains, but it helps the market handle big demand and sharp price swings more smoothly. What Is

10 min read

19 Feb, 2026

Essential

What is Call Option?

In equity and derivatives conversations, the term Call Option appears very frequently. For many new investors it sounds technical, even intimidating. Yet at its core, a call is simply a contract that gives someone the right to buy an asset at a fixed price in the future. Once this idea is clear, the rest of

8 min read

18 Feb, 2026

Essential

Understanding Forward Price

Markets love certainty, but prices rarely stand still. Equity indices move every minute, commodity prices react to global headlines and currency rates swing with every policy comment. In this restless backdrop, many institutions and businesses want clarity about what a future price will be. That is where the idea of Forward Price enters the story.

8 min read

18 Feb, 2026

Essential

What is Underlying?

In modern finance, several products look complicated on the surface, but most of them rest on a very simple idea – the Underlying. Whether it is a stock option, a commodity future, or a currency forward, everything finally traces back to one basic asset sitting at the core. Understanding that base is what helps an

6 min read

06 Feb, 2026

Essential

Advantages of a Fixed Deposit (FD) in India: The Real Benefits, Explained

Fixed Deposits represent a long-standing instrument in wealth management, valued primarily for their resilience during periods of market volatility. Rather than serving as a vehicle for aggressive capital appreciation, FDs function as a secure foundation for investors who prioritize transparent yields and risk mitigation. With predetermined interest rates and fixed maturities, they provide the structural

4 min read

06 Feb, 2026

Essential

How to Open a Recurring Deposit (RD) Account in India

For individuals seeking to establish a disciplined savings regimen, a Recurring Deposit (RD) serves as an effective foundational tool. This financial instrument eliminates the need for significant capital outlays or extensive administrative formalities. By committing a fixed monthly sum, you can ensure consistent capital growth through accrued interest. The following guide outlines the core mechanics

6 min read

06 Feb, 2026

Essential

Recurring Deposits vs SIP: What Should You Pick in India?

Establishing a consistent monthly savings habit is a fundamental pillar of financial discipline; the commitment to regular contributions is often the most significant factor in long-term wealth accumulation. However, once the decision to save is made, selecting the appropriate financial vehicle becomes the primary objective. In the Indian financial landscape, investors typically evaluate two primary

6 min read

05 Feb, 2026

Corporate Bonds Investing – Key Terms to Know Before Investing

If you’re new to investing, the terminology can feel like a wall. Equity dominates most conversations, so it’s easy to miss an asset class that many investors use for structure, predictability & regular income: corporate bonds. What Are Corporate Bonds? A corporate bond is a company’s way of borrowing from investors instead of borrowing only

9 min read

20 Jan, 2026

Essential

What is Sweep-in FD? Meaning, Interest Rate, Benefits

Many investors face a common dilemma: keeping funds in a savings account offers high liquidity but low returns, while locking money in a Fixed Deposit (FD) offers higher interest but locks your funds for any withdrawals. The banking sector solves this problem with an interesting facility known as the Sweep-in FD. This financial tool essentially

9 min read

20 Jan, 2026

Essential

Post Office Fixed Deposit: Interest Rate, Tenure and More

There are some money habits that feel almost “Indian by default.” One of them is the quiet comfort of a post office savings product. Many families still remember the old passbook, the long queue at the counter, and the feeling that whatever you deposited there was not going to vanish overnight. That sentiment is exactly

6 min read

20 Jan, 2026

Essential

Certificate of Deposit vs Fixed Deposit: What’s the Real Difference?

If you’ve ever tried to park money “safely” for a few months or a year, chances are someone has suggested an FD. And if you’ve spent a little more time reading about money markets, you may have stumbled upon something called a Certificate of Deposit (CD). At first glance, both look similar: you lock money

Bonds you may like...

ESAF SMALL FINANCE BANK LIMITED

Coupon

11.6500%

Maturity

Feb 2032

Rating

Type of Bond

Subordinate Debt Tier 2 - Lower

Yield

12.1613%

Price

₹ 1,01,276.71

MANBA FINANCE LIMITED

Coupon

10.9500%

Maturity

Oct 2027

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.2500%

Price

₹ 1,00,702.00

NAMRA FINANCE LIMITED

Coupon

11.3500%

Maturity

Dec 2027

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.2500%

Price

₹ 1,02,819.04

EARLYSALARY SERVICES PRIVATE LIMITED

Coupon

10.5000%

Maturity

Mar 2028

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.1500%

Price

₹ 99,647.56

EARLYSALARY SERVICES PRIVATE LIMITED

Coupon

10.7000%

Maturity

Aug 2027

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.1000%

Price

₹ 1,00,094.77

KRAZYBEE SERVICES LIMITED

Coupon

10.5000%

Maturity

Dec 2027

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

10.9000%

Price

₹ 1,00,275.87

MUTHOOT MICROFIN LIMITED

Coupon

9.9500%

Maturity

Dec 2028

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

10.8500%

Price

₹ 99,322.22

MUTHOOT MICROFIN LIMITED

Coupon

9.8500%

Maturity

Dec 2027

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

10.7500%

Price

₹ 99,531.90

Note:

The listing of products above should not be considered an endorsement or recommendation to invest. Please use your own discretion before you transact. The listed products and their price or yield are subject to availability and market cutoff times. Pursuant to the provisions of Section 193 of Income Tax Act, 1961, as amended, with effect from, 1st April 2023, TDS will be deducted @ 10% on any interest payable on any security issued by a company (i.e. securities other than securities issued by the Central Government or a State Government).

Note: The listing of products above should not be considered an endorsement or recommendation to invest. Please use your own discretion before you transact. The listed products and their price or yield are subject to availability and market cutoff times. Pursuant to the provisions of Section 193 of Income Tax Act, 1961, as amended, with effect from, 1st April 2023, TDS will be deducted @ 10% on any interest payable on any security issued by a company (i.e. securities other than securities issued by the Central Government or a State Government).