Online Bond Yield Calculator – Simplifying Bond Yield and Bond Price

On investments in general, financial returns are expressed on per annum or per year basis. Simply put if you invest INR 100 and make INR 10 in one year, then your return is 10%. But if you make the same INR 10 in 2 years, then your return is just 10÷2 = 5%. Bonds typically have income streams spread over years. Hence, accounting for all those future cash flows post investment and expressing it as one single number for easy understanding is essential.

The most important terminology that accounts for all future cashflows in bonds and that one number is Bond Yield. Oxford Dictionary meaning of “yield” is to ‘provide or produce something’.

Hence, Bond Yield just means what a bond produces or what financial returns you get from bonds over its time period of existence.

This is expressed as a percentage. Hence, a Bond Yield of 7.5% means you earn 7.5% returns on the bond when you hold it to its maturity (also known as Yield to Maturity).

What is a Bond Yield Calculator?

Bond Calculator is a mathematical tool that allows investors and issuers to calculate Bond Yield at a specific price or Bond Price at a desired level of yield. Calculations on bonds need various factors as input like coupon interest, coupon payment dates, maturity date, issue price, government holiday calendar for adjustments, principal repayment schedule and many more. Typically, large institutions involved in bond investments build this capability using statistical formulae, as this is their core business. For individual investors, trusts and small treasuries, it is a cumbersome task to stay on top of the thousands of bonds that are outstanding! Hence a standard Bond Calculator can assist where investors have to input all the variables to get their desired calculations.

How Bond Yield Calculator Works

A bond yield calculator takes a few simple inputs and turns them into the number investors care about most: the annualised return. You enter the bond’s face value, coupon rate, coupon frequency (monthly/quarterly/annual), market purchase price (or clean price), settlement date, and the maturity date. Using these details, the calculator first computes accrued interest and the “dirty price” (clean price + accrued). It then applies an internal-rate-of-return (IRR) method to equate the present value of all future coupon payments plus redemption amount to the price you pay today. The result is Yield to Maturity (YTM)—your annualised return if you hold the bond to maturity and receive all payments on time. Many calculators also display the current yield (annual coupon ÷ market price) and, where relevant, yield to call/put based on the next call/put date. Behind the scenes, it iterates to the precise yield rather than using a rough shortcut, so the output reflects the timing of cashflows, frequency of coupons and day-count conventions. In short, you input the bond’s facts; the calculator standardises them and returns an apples-to-apples yield.

Advantages: Bond Yield Calculator

A yield calculator saves time and removes guesswork. Instead of mentally juggling coupon amounts, dates and prices, you get an instant, standardised YTM that makes two bonds comparable—irrespective of their coupon rates or market prices (discount/premium). It’s also a powerful “what-if” tool: tweak the purchase price, settlement date or coupon frequency and see how the yield moves before you place an order. Because it uses precise cashflow timing, it reduces manual errors and brings transparency to secondary-market quotes. For investors building ladders or targeting specific cashflow dates, the calculator clarifies whether a bond truly meets the return objective after accounting for accrued interest. Many tools additionally show current yield and yield to call, helping you understand income today versus total return if the bond is redeemed early. Overall, a bond yield calculator turns scattered details into a single decision number, improves comparability across issuers and tenors, and supports more disciplined portfolio choices.

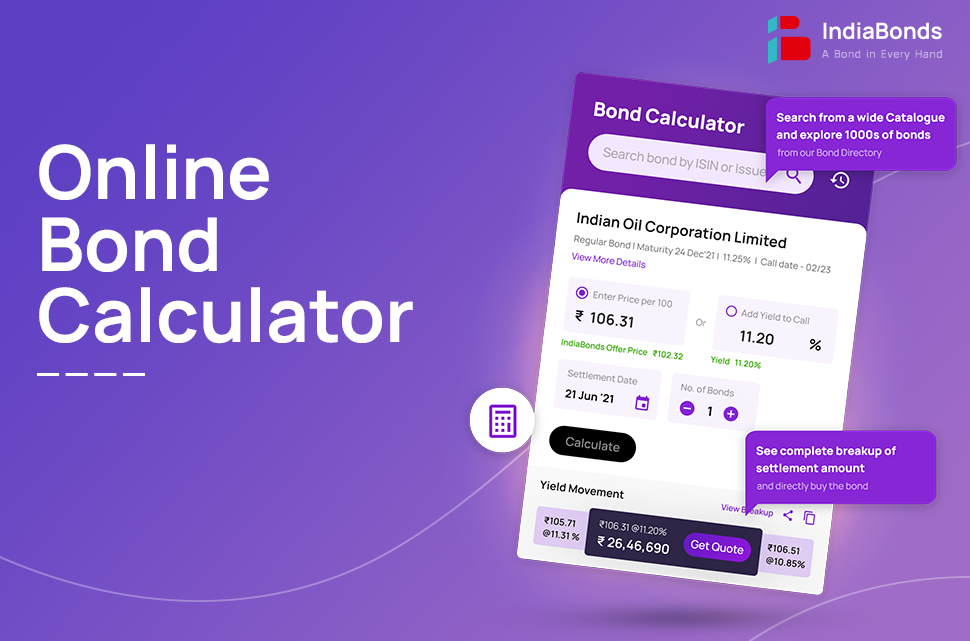

IndiaBonds Bond Calculator

This is an innovative solution for the needs of investors. IndiaBonds Bond Calculator helps you to calculate Bond Yield or Bond Price for thousands of bonds in India. It is a complex mathematical tool that simplifies the task for investors and institutions and gets them numerical answers instantly! All the variables and formulas are already present in this calculator hence user has to just choose the bond, input a price or desired yield and enter settlement date to get answers.

The benefits of this calculator are:

- Access to All – IndiaBonds’ intention is to empower investors with innovative tools for their bond investments. The Bond Calculator can be accessed by anyone simply by signing up on the website. It is for everyone involved or want to learn on bonds, whether they be professionals, individual investors or keen learners.

- Ease of Use – The Bond Calculator sits as a small widget on your IndiaBonds website and can be easily opened up anytime whether on mobile or desktop. The flow is very easy and logical where all you need is to enter price to calculate yield or desired yield for equivalent price. You can get calculations on 1000s of bonds and their yield to maturity in India at your fingertips and even on the move!

- Available Anytime Anywhere – The bond markets rely heavily on complex cashflow spreadsheets for computing bond yields and bond prices. These are usually in office environment and very desktop/laptop oriented. Individual investors have to call their advisors or build their own spreadsheet for calculation or even for verifying prices. All this goes away in a second! No more waiting for offices to open or someone to pick up your call to give you the answers. You can do this yourself on your mobile. Bond Calculator is available to you 24/7 – anytime and anywhere!

- Detailed Breakup – The Bond Calculator does not simply just tell you bond yields and bond prices. It actually gives you a detailed breakup of principal, accrued interest and total settlement amounts. It also lets you adjust settlements dates to match your cash flows. The calculator takes into account the holiday calendars as well for accuracy.

- Swap and Compare Bonds – We completely understand that bond investors may need to compare different bonds to suit their investment needs. The Bond Calculator lets you compare and swap between bonds with ease. You do not have to input the bonds you are looking at again and again. Just quickly continue from the bonds you were working on once logged in the calculator. This is designed to make your life simpler!

- Make Requests for Price – This calculator allows you to easily request for a bid or offer price on any particular bond of your choice with ease. While IndiaBonds has the largest inventory of bonds on offer, we are more than happy to accommodate your requests and work towards delivering your investment goals.

- Connect with a Bond Manager – The Bond Calculator is designed to make decisions by investors simpler. The navigation and computation are easy to understand as we know investors like to explore things at their own leisure and time. However, in case you feel the need to speak with an expert, you can connect with our Bond Managers anytime with a click either through live chats or phone calls.

Watch the video to learn how to use Indiabonds’ Bond Calculator!

The Future of Bond Investments is Here

At IndiaBonds, we aim to provide investors with tools and solutions to make their investment decisions easier. True technology revolutions are about innovative ideas to make consumer activity simpler. The Online Bond Yield Calculator is one such powerful tool for bond investors all across the country. Not only is it our mission to have a Bond in Every Hand… but also a Bond Calculator in Every Hand!

Unleash the power of the online Bond Yield Calculator now and here

FAQs

Q. What is the relationship between bond prices and bond yields?

They move in opposite directions. When market interest rates or credit spreads rise, existing bond prices fall so that their fixed coupons offer a higher yield to new buyers; when rates fall, prices rise and yields drop. This inverse link comes from discounting fixed future cashflows at changing market rates.

Q. How does the calculator determine the current yield?

Current yield is simply the annual coupon divided by the bond’s current market price (often the clean price; some tools allow dirty price). It shows income relative to today’s price, but it does not include capital gain/loss at redemption or the exact timing of cashflows—YTM captures those.

Q. What information do I need to use a bond yield calculator?

Provide face value, coupon rate, coupon payment frequency, market price (clean), settlement date, maturity date, and—if applicable—call/put dates. Optional fields can include day-count convention and taxes. With these, the calculator computes accrued interest and returns YTM/current yield accurately.

Disclaimer: Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.