What is Delta?

Definition

Delta in investing, particularly in options trading, is a measure of an option’s price sensitivity to a Re. 1 change in the price of the underlying asset. It is one of the “Greeks,” a set of risk measures used in options trading.

What Is Delta? And Key Takeaways

Delta is a way to see how much an option’s price is expected to change for every Re. 1 change in the price of the asset. It helps investors see how sensitive their option is to market movements. In simple terms, delta tells you how much the price of your option will move if the stock or bond price moves by ₹1.

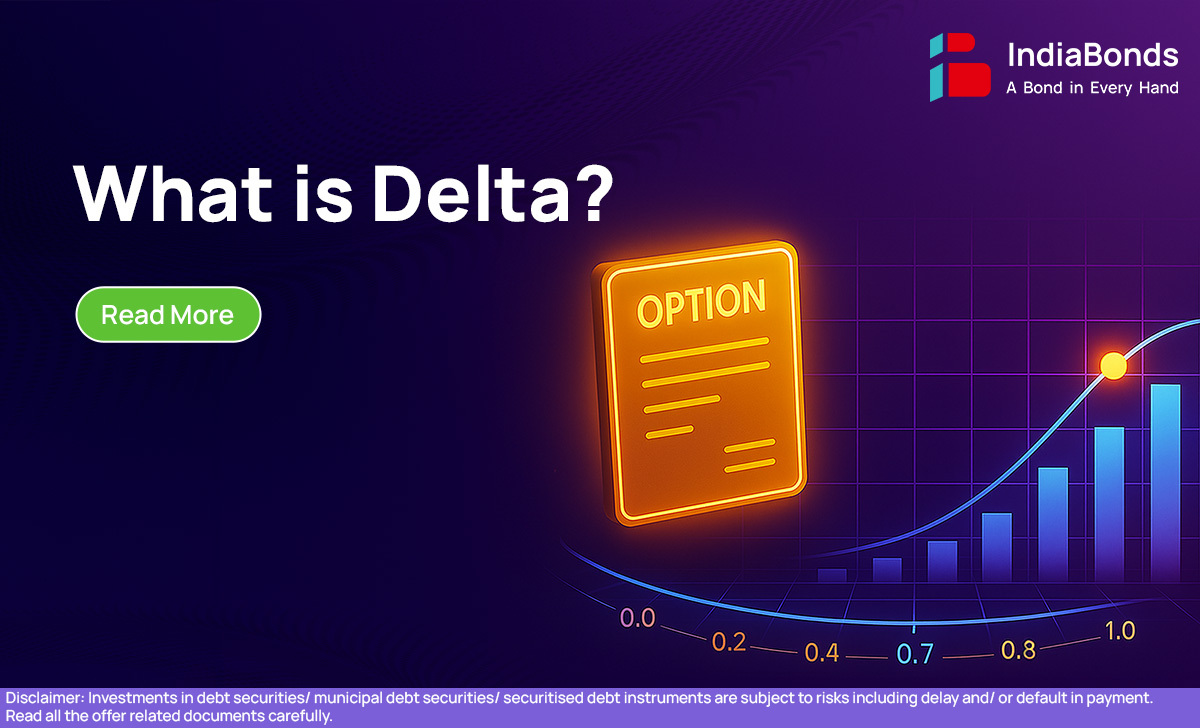

- Delta tells you how much an option’s price is expected to change when the price of the thing it’s connected to (like a stock) changes.

- For options to buy, this number is always between zero and one. For options to sell, it’s always between minus one and zero.

- A delta of 0.6 means the option price will move ₹0.60 for every ₹1 move in the underlying asset.

- Delta can also give you a rough idea of how likely it is that the option will be profitable when it expires.

- It’s a really important tool for protecting your investments and managing potential losses.

- Traders use delta to build a portfolio where the overall price isn’t expected to change much with small movements in the underlying asset’s price – this is called being “delta-neutral.”

- It’s important not to confuse this with how bond prices change when interest rates change; that’s a different kind of sensitivity.

Understanding Delta

It simply means seeing how much an option’s price is likely to change when the price of whatever it’s linked to (like a bond) moves. Imagine you own an option that gives you the right to buy a bond. If the bond price increases, the value of your option should increase too. Delta quantifies that change.

For example, if your option has a delta of 0.5, and the bond price goes up by ₹2, your option’s price should rise by ₹1. This gives investors a powerful way to gauge risk and plan strategies. In delta in investing, this becomes a vital metric for timing entry and exit, especially when markets are volatile.

The delta can also change based on the time to expiration, volatility of the asset, and shifts in the delta interest rate, which is important in bond pricing and interest rate swaps.

Delta vs. Delta Spread

Delta is like understanding how much one specific lever moves when you push on it. It shows how much a single option’s price is expected to change when the price of the thing it’s based on changes.

A delta spread, however, is like setting up a system of different levers working together. You might push down on one lever (buy an option) and that causes another lever to lift up a bit (sell another option). The whole system then has a specific overall movement (the net delta).

So, instead of just betting on one lever going up or down a lot, with a delta spread, you create a more controlled setup. You limit how much the whole system can move up or down, but it still reacts to the push you give it. This helps investors make strategic moves based on where they think prices might go, without having to make a big, all-in bet in one direction. Understanding delta is key to setting up these smarter lever systems in the investing world.

Call and Put Option Deltas

Understanding how delta works in call and put options is key for anyone exploring the world of derivatives or bonds with embedded options.

Call Option Delta

Always positive, ranging from 0 to 1. A call option with a delta of 0.7 means there’s a 70% chance it will expire in-the-money. It will move ₹0.70 for every ₹1 increase in the asset’s price.

Put Option Delta

Always negative, ranging from -1 to 0. A put option with a delta of -0.6 will move ₹0.60 (in the opposite direction) for every ₹1 fall in the asset price.

For bond investors, especially those asking what is delta bond, it’s important to remember that delta can also reflect how bond prices move with interest rate shifts—this is where delta interest rate matters most.

Examples of Delta

Let’s make delta easier with examples:

- You buy a call option on a bond that currently has a delta of 0.5. If the bond’s price rises by ₹10, the option’s price is likely to increase by ₹5.

- A put option with a delta of -0.4 on the same bond will gain ₹4 if the bond’s price drops by ₹10.

These examples help highlight what is delta bond — essentially, it’s about predicting how bond values or options on bonds will move when interest rates or market conditions shift.

How Do Options Traders Use Delta?

Options traders use delta for a range of purposes:

Hedging:

A trader might use options to neutralize exposure to an asset. If they hold a stock, they might buy a put option with a delta of -1 to offset downside risk.

Speculating:

Traders can use high-delta options to bet on price moves. A delta close to 1 or -1 means the option behaves almost like the asset itself.

Building Strategies:

Strategies like delta-neutral portfolios help manage risk in a more controlled way, even when the markets move unpredictably.

In delta in investing, these applications make delta an everyday tool in a trader’s toolkit.

What Is a Portfolio Delta?

Portfolio delta refers to the combined delta of all positions in an investment portfolio. It helps assess overall exposure to market movements.

Let’s say you own three different options:

- One has a delta of 0.5

- Another is -0.3

- And the third is 0.7

The portfolio delta is 0.9, meaning your portfolio will gain ₹0.90 for every ₹1 move in the underlying asset’s price. Understanding portfolio delta is especially useful in large institutional setups or when managing high-value bond portfolios.

The Bottom Line

Delta is one of the most essential concepts in options trading and bond valuation. Whether you’re asking what is delta bond or trying to understand how the delta interest rate affects your investments, this measure can help guide better decisions.

In short, delta helps you:

- Predict price movements

- Estimate probability of profitability

- Create risk-hedged strategies

From novice investors to experienced traders, understanding delta can be a game-changer.

FAQs

1. What is delta in investing?

It measures how much an option or derivative’s price changes with the underlying asset’s price.

2. What is delta bond?

It refers to bond-linked instruments whose value moves with interest rate or price changes.

3. What is delta interest rate?

It shows how sensitive a bond’s price is to interest rate movements.

4. How does delta help in bond investing?

It helps investors manage risk and estimate how much prices may change.

5. What is a good delta for options?

A high delta (near 1 or -1) means more sensitivity. It depends on your risk strategy.

6. Why is understanding delta important?

It helps you make better investment decisions and hedge against risks.