February 2026 Monetary Policy

The RBI’s Monetary Policy Committee (MPC) conducted its monetary policy meeting from February 4 to February 6, 2026.

On the basis of an assessment of the evolving macroeconomic situation, the Monetary Policy Committee (MPC) made the following announcements:

- The MPC unanimously decided to maintain the repo rate at 5.25%. Consequently, the SDF rate was maintained at 5.00%.

- The Marginal Standing Facility (MSF) rate and the Bank Rate were also kept unchanged at 5.50%.

- MPC has also decided, by a majority of 5:1, to keep the stance unchanged at Neutral, with one dissenting member voting for an Accommodative stance.

Part A: RBI’s Policy Decision Rationale:

1. Inflation

Headline CPI inflation remained low in Nov’25 and Dec’25 even as it firmed up by one percentage point in these two months. This increase was largely driven by the lower rate of deflation in the food group. Excluding gold, core inflation remained stable at 2.6% in Dec’25. Near-term outlook suggests that food supply prospects remain bright on the back of healthy kharif production, sufficient buffer stocks of food grains, favourable rabi sowing and adequate reservoir levels. Core inflation, barring potential volatility induced by prices of precious metals, is expected to be range-bound. Geopolitical uncertainty coupled with volatility in energy prices and adverse weather events pose upside risks to inflation.

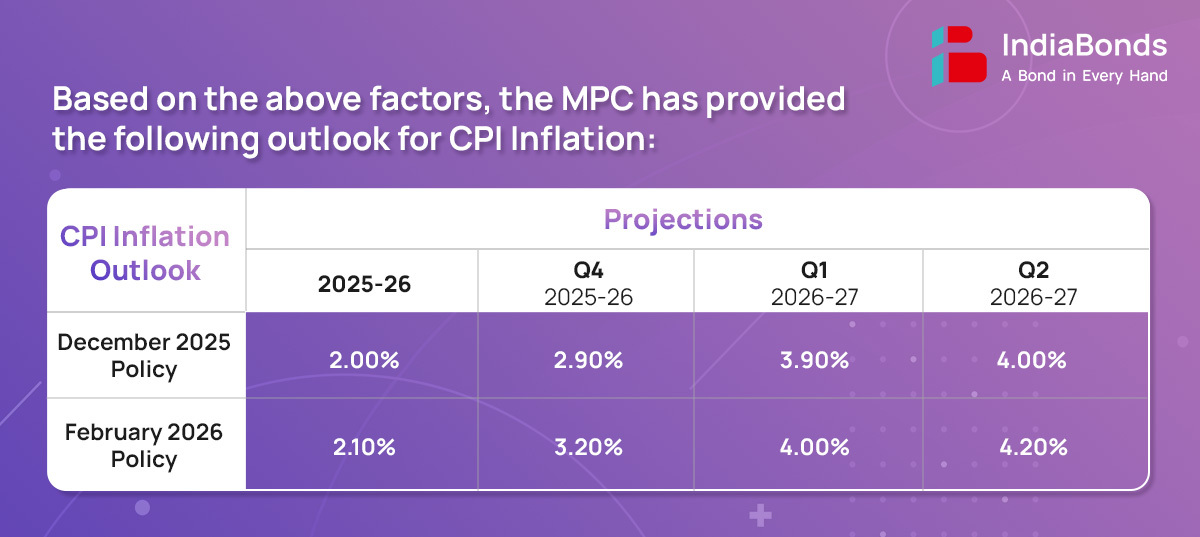

The MPC expects CPI outlook to be shaped by several factors such as:

- In terms of the headline inflation trajectory, the anticipated momentum is expected to remain muted.

- However, unfavourable base effects stemming from the large decline in prices observed during Q4:2024-25 would lead to an uptick in y-o-y inflation in Q4:2025-26.

- Excluding precious metals, the underlying inflation pressures remain muted.

- Considering all these factors, CPI inflation for 2025-26 is projected at 2.1% with Q4 at 3.2%. CPI inflation for Q1:2026-27 and Q2 are projected at 4.0% and 4.2%, respectively.

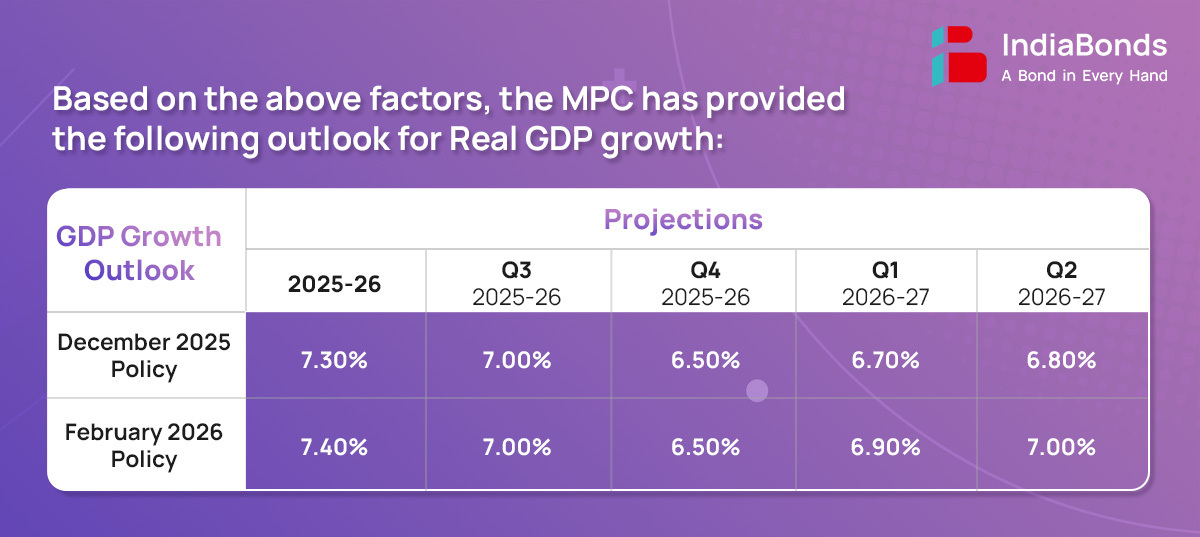

2. Growth

The Indian economy continues on a steadily improving trajectory, with real GDP poised to register significantly higher growth of 7.4% in FY25-26, as compared to the previous year. Amidst global headwinds, private consumption and fixed investment supported growth. On the supply side, growth in real GVA, on the back of a strong contribution from the services sector and revival in manufacturing activity, is estimated at 7.3% in FY25-26. On the demand side, the momentum in private consumption is expected to sustain in 2026-27. Moreover, several measures announced in the Union Budget should also be conducive for growth. The recently concluded India-EU FTA and the India-USA trade deal along with several other trade agreements will support exports over the medium-term. Services exports should remain resilient. The spillovers emanating from geopolitical tensions, volatility in international financial markets and shifting trade patterns pose risks to the outlook.

The MPC expects real GDP to be based on the following factors:

- Agricultural activity will be supported by healthy reservoir levels, robust rabi sowing, and improvement in crop vegetation conditions.

- Improving corporate sector performance and sustained momentum in informal sector should boost manufacturing activity. Construction sector growth is expected to remain firm.

- Taking all these factors into consideration, real GDP growth projections for Q1:2026-27 and Q2 are revised upwards to 6.9% and 7.0%, respectively.

3. Liquidity

System liquidity has remained in surplus, averaging Rs. 70,000 cr per day since the last MPC meeting, supported by RBI measures.The Reserve Bank conducted OMO purchase auctions amounting to Rs. 3,50,000 cr and long-term forex buy/sell swap auction of USD 15.1 billion in December 2025 and January 2026.In response to the cumulative 125 bps cut in the repo rate, the weighted average lending rate (WALR) of SCBs declined by 105 bps for fresh loan.

Going ahead, RBI will remain proactive in liquidity management and ensure sufficient liquidity in the banking system to meet the productive requirements of the economy and to facilitate monetary policy transmission.

4. Global Economy

The global economy is expected to be marginally stronger in 2026, supported by tech-investments, accommodative financial conditions and large-scale fiscal stimulus. While manufacturing is slowing down, the services sector continues to perform well. However, the confluence of escalating geopolitical frictions and rising trade tensions is unraveling the existing world economic order. Inflation outcomes are heterogeneous across jurisdictions, remaining above target in most major advanced economies prompting a divergence in monetary policy actions.

Part B: Key Statements on Developmental and Regulatory Policies:

1. Financial Markets

Development of corporate bond market: In the Union Budget speech on February 1, 2026, the government announced the introduction of total return swaps on corporate bonds and derivatives on corporate bond indices. An active derivatives market is expected to improve credit risk management, enhance liquidity and efficiency, and support corporate bond issuance across rating categories. A regulatory framework for these instruments will be issued shortly for public feedback.

Review of the Voluntary Retention Route for FPI investment in debt instruments: VRR seen strong uptake, with over 80% of the ₹2.5 lakh crore limit utilized. To improve predictability and ease of doing business, investments under the VRR will now be counted within the General Route limits, along with additional operational flexibilities for FPIs.

Foreign Exchange Dealings of Authorised Dealers: In line with evolving domestic and global market practices, the regulatory framework governing these Authorised Dealers has been reviewed and refined to provide greater flexibility in foreign exchange products, risk management, and trading platforms.

2. Credit Facilitation:

Exemption from registration to eligible NBFCs: Given their low systemic risk, it is proposed that Type-I NBFCs without public funds or customer interface and with assets up to ₹1,000 crore be exempted from registration with the Reserve Bank, subject to specified conditions.

Enhancement in Collateral free loan limit: To improve access to formal credit, support entrepreneurship, and strengthen last-mile credit delivery for Micro and Small Enterprises (MSEs), the limit for collateral-free loans has been enhanced from ₹10 lakh to ₹20 lakh.

Bank Lending to REITs: While bank lending to InvITs was permitted, lending to REITs was not allowed. Considering the robust regulatory and governance framework for listed REITs, it is now proposed to allow banks to lend to REITs.

Review of Lending norms for UCBs: RBI has proposed to rationalise regulatory norms for unsecured loans by UCBs, lending limits to nominal members, and tenor and moratorium requirements for housing loans. Proposal of a simplified approach while maintaining prudential discipline, reflecting the growth in UCBs’ loan portfolios.

The next meeting of the MPC is scheduled for April 6-8, 2026.

DISCLAIMER: Investments in debt securities/ municipal debt securities/ securitized debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.