Difference Between Bonds & Post Office FD

Introduction

If you happen to be an investor with a limited risk appetite and are looking for investment options with an assured return on the capital, bonds and fixed deposits are ideal for you. Fixed deposits are accepted by both banks as well as Post Offices across the country. Both these investment options are low risk compared to the other tools available giving you a return at a prefixed rate of interest. It is always advisable to include bonds and fixed deposits in your investment portfolio, as their steady nature lends your portfolio the much needed stability. If you are investing at present to fulfil some of your goals for the future, you will be able to ascertain the amount of funds that will be available to you when required.

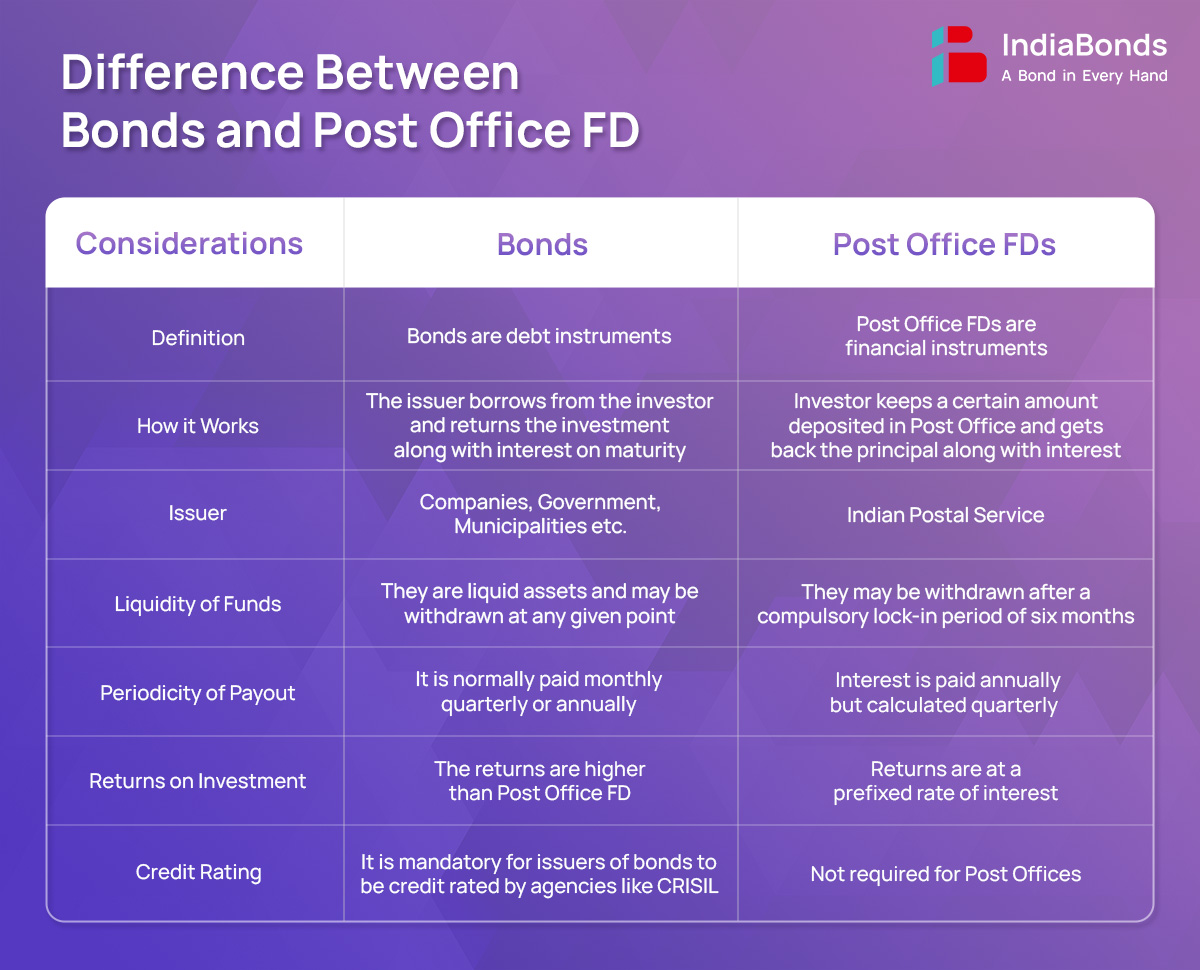

However, there are some fundamental differences between bonds and Post Office fixed deposits. In the later section, the matter has been discussed upon in detail.

What is a Post Office Fixed Deposit?

As an investment option fixed deposits are a relatively safe investment option. The return on your investment is guaranteed at a prefixed rate. Fixed deposits are accepted by banks, non-banking financial companies and post offices. A post office fixed deposit is one issued by Post Office. It is also called post office term deposits. The issuer of the post office fixed deposits is Indian Postal Services. The Government of India stands as the sovereign guarantor for post office fixed deposits. As on November 2022 the rates of interest range between 5.5% and 6.7% depending on the period of the deposit.

What is Post Office FD Rates?

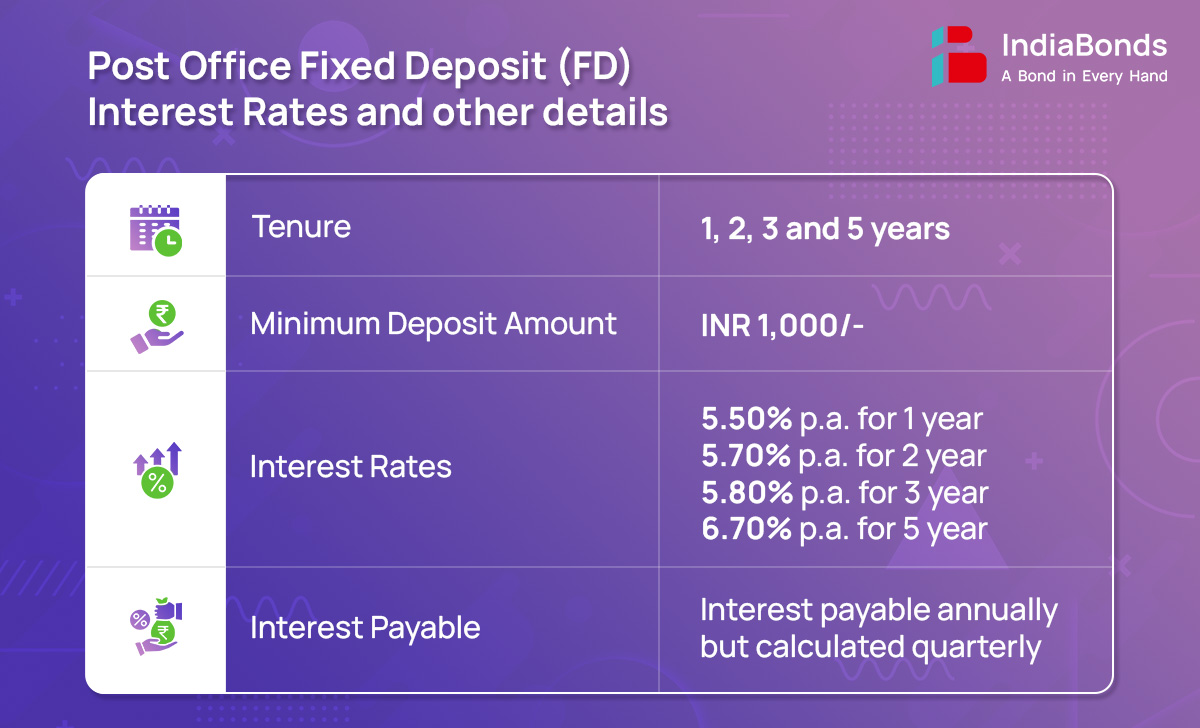

The current rates of interest on Post Office Fixed Deposit (POFD) or Post Office Time Deposit (POTD) are as under:

Note – these rates are effective October 1, 2022. The interest rates are calculated on a quarterly basis but payable annually. The minimum deposit is Rs. 1000/- and in multiples of Rs. 100/- thereon with no upper limit.

Features and Benefits of Post Office FD

There are several benefits of investing in Post Office Fixed Deposits. To name a few:

Fixed Returns on Investment –

The Post Office FD come with a guaranteed return on the investment. It is the safest form of investing as it is insulated from all market risks.

Guaranteed by the Government of India –

The Post Office FD comes with a sovereign guarantee by the Government of India which makes this investment the safest possible option.

Facility of Premature Withdrawal –

In case you need any emergency funds you have the option to break the fixed deposit and withdraw the amount prematurely into your designated bank account.

Loan Against Deposit –

You may avail of loans pledging your Post Office Fixed Deposit.

Income Tax Implications –

TDS is not deducted on the interest earned on Post Office FD.

Some of the salient features of Post Office FD include:

- Only an Indian Citizen may have an FD account with Post Office

- The scheme is not available for NRIs or Trusts.

- A minor who is an Indian citizen above 10 years of age may open a Post Office FD account in their name.

- There is a compulsory lock-in period of six months before you may apply for premature withdrawal of Post Office FD.

- You may opt for an extension of Post Office Fixed Deposit for another tenor on the expiry of the current term.

- Post Office FD Scheme for five years qualifies for exemption under Section 80C of the Indian Income Tax Act, 1960.

What are Bonds?

Bonds are another form of fixed-income investment tool that is preferred by investors who have a limited appetite for risks and are looking for steady income. In a bond, the issuer organization takes a loan from you. Upon maturity of the bond, the issuer company returns the money to you with interest.

Benefits of Bonds

Bonds are a preferred investment option if you are a conservative investor. The benefits of bonds include:

1. Low-risk Investment Option:

Investment in bonds is deemed to be low risk and they give you steady pre-determined returns. They are much less volatile than equities.

2. Higher Rate of Return than Fixed Deposits:

Bonds can help you earn upto 12% returns on your investments. The rate of interest that you are likely to earn out of bonds is higher than fixed deposits.

3. Returns on Bonds are Predictable:

When you are investing a portion of your income, the sole aim is to earn interest out of the same. In the same breadth, you need to have some predictability factor in your investment. Bonds make a very good choice as retirement benefits where you need a certain amount every month as the regular flow of income dries up. Invest in bonds on the basis of the interest payout frequency options offered by the issuer (monthly, quarterly or annually) basis your needs.

4. Helps in Diversifying your Investment Portfolio:

Returns on stocks are normally at a rate higher than a bond. At the same time, there are market volatilities that are inherently a component of income out of shares. There may be a situation where you lose heavily on stocks due to some unforeseen market conditions. Bonds give you an assured income thereby ironing the fluctuation of income out of your investments.

5. Capital Appreciation:

Unlike Fixed Deposits where there isn’t much scope for your initial investment to appreciate, Bonds give that power to investors. When the market interest rates fall causing the price of bonds to rise as a domino effect, investors stand to benefit from capital appreciation where their initial investment appreciates.

Conclusion

While concluding the discussion on bonds and Post Office FDs one may say that both are relatively safe investment options. Both these investment options have their unique features which need to be studied carefully before parting with your money. For example, there is an undeniable portion of uncertainty in the case of investing in bonds. Whereas, Post Office FDs are an absolutely safe option as they are backed by the government of India.

You need to have a clear understanding of your financial goals and the financial requirements for fulfilling them. A well-researched investment decision is an ideal situation where you possess the required knowledge about the various investment options beforehand.

Disclaimer: Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.