The coupon rate and bond yield are important concepts associated with bonds. If you want to invest in bonds, you should know about the bond coupon, bond yield, bond investment return, and the major differences between coupon rate and bond yield (Coupon Vs Yield).

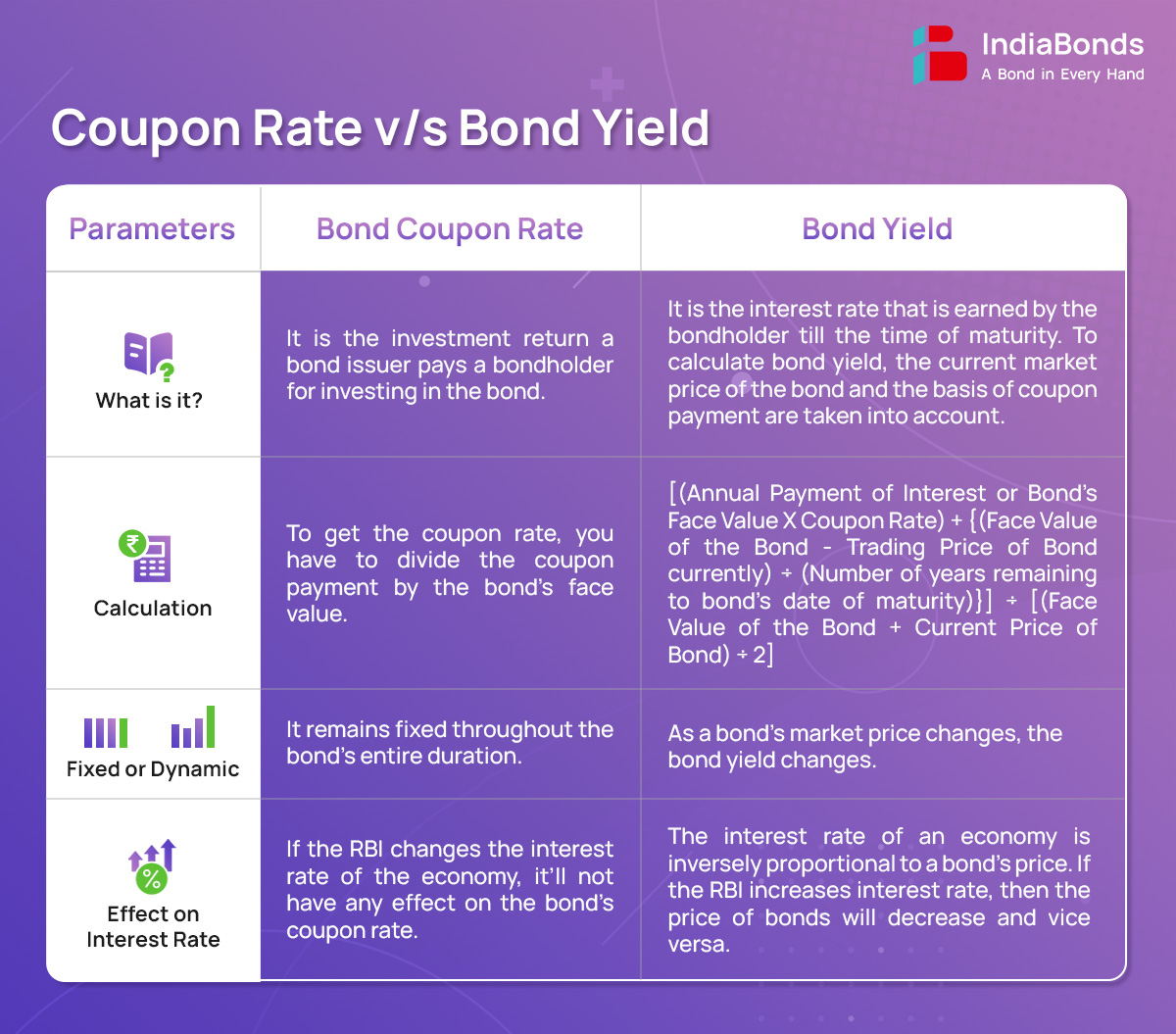

A coupon is a payment a bondholder receives from a bond issuer as a return on his/her investment in the bond. Bond yield, on the other hand, is the interest rate on the bond. The interest rate on the bond is calculated on two factors:

The above-mentioned factors make the market price of bond change. Before checking the difference between these two concepts on bond, let’s explore these concepts.

The coupon rate is the rate at which interest payment is paid by the bond issuer annually to the bond investor. A bond’s coupon rate is dependent on the bond’s face value, which is the amount of money the bondholder receives at the time of the bond’s maturity. Let’s try to understand this concept with the help of an example.

Suppose, an ABC bond’s face value is ₹ 20,000 and the bond’s interest rate is set at 10% per annum (p.a.). The bond interest rate is the coupon rate. This means the holder of the bond will receive an interest payment of ₹ 2,000 p.a.

Bond yield is the rate of return generated by the bond if an investor holds it till maturity. That’s why it is also called the yield on maturity. The bond yield calculation will matter only when you purchase bonds from the secondary market. The formula to calculate bond yield is given below:

Bond Yield or Yield of Maturity =

[(Annual Payment of Interest or Bond’s Face Value X Coupon Rate) + {(Face Value of the Bond – Trading Price of Bond currently) ÷ (Number of years remaining to bond’s date of maturity)}] ÷ [(Face Value of the Bond + Current Price of Bond) ÷ 2]

Let’s try to understand the concept of bond yield with the help of an example.

Suppose, ₹ 20,000 is the face value of a certain bond. Let’s also assume that:

With the above-mentioned figures, let’s calculate the bond yield or yield of maturity. The calculation will be like this:

Bond Yield or Yield of Maturity

= [(₹ 2,000) + {(₹ 20,000 – 19,280) ÷ (3)}] ÷ [(₹ 20,000 + ₹ 19,200) ÷ 2]

= 11.452%

Now, let’s check the differences between the bond coupon rate and bond yield.

Coupon Rate is important for a bond investor who buys in primary and intends to hold the bond till maturity. For them bond price changes or bond yields do not matter. However, in the case of secondary market the bond yield is most important for bond investors. This is mainly because the yield of a bond takes into consideration the potential profit/loss caused by changes in a bond’s market price.

Coupon rate is decided at the time of primary issuance of the bond and dependent on many factors such as interest rates in the economy, health of the company at that time (credit rating) and demand/supply factors. Hence higher coupon rate does not necessarily increase risk factor on its own. It has to be compared with bonds from same industry sector or ratings etc.

The coupon rate of a bond is independent of a bond’s price. This rate remains fixed throughout the tenure of the bond. Bond yield is same as coupon rate when the bond is trading at the issue price or par. However bond yield will be higher than coupon if the market price is below par, If the bond is trading above par or at premium, then the bond yield will be lower than the coupon rate.

Disclaimer: Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.