What is a Bond IPO – Debt Public Issue

Introduction

Economic growth for a country is led by public investment done by the government and private investment done by companies. This requires money (or capital) from other people; as owners themselves may not have all the resources to invest in growth. Traditionally in India, banks have been the primary source of capital for firms. As the economy modernizes and banks face lending constraints, financial markets become an important provider of capital in India. Companies raise this capital through bonds (debt) and equity issuances from the markets as this gives them greater ability to grow and expand.

What is an IPO?

The meaning of an IPO is Initial Public Offering. It literally means issuing securities of the company for the first time to the public for investment. This is the stage where a company, which had been held privately by a handful of promoters/investors, is now raising money from the public in general. The term IPO has become popular due to the equity market as it has been in practice there for many decades. Hence, when a company raises money for the first time from the public in the form of bonds – it’s called a Debt or Bond IPO.

However, in debt markets, companies raise capital via public issuance of bonds quite frequently, sometimes even more than once a year. Market participants in general call every public bond issuance as an Initial Public Offering, or an ‘IPO’, which is technically incorrect since the word IPO only stands for raising initial capital or for the very first time. Subsequent issues are termed ‘Public Issues of Bonds’. For this article we will use the term ‘Debt Public Issue’ and ‘Bond IPO’ interchangeably.

How Does a Bond IPO Work?

A Bond IPO (public issue of non-convertible debentures/NCDs) lets an issuer raise money directly from investors for a fixed period at a pre-declared coupon. The issuer files an offer document with key details—tenor options (series), interest rate and payout frequency, credit rating, security/charge, and category-wise quotas (Retail, HNI, Institutional). During the open window, investors apply via OBPPs, brokers, or ASBA/UPI using their PAN and demat. Applications are recorded on the exchange platform and funds are blocked until allotment. If the issue is oversubscribed, allotment follows the rules in the prospectus (often on a first-come-first-serve within category or proportionate basis). Post-allotment, NCDs are credited to your demat and typically list on NSE/BSE, allowing secondary-market trading. Thereafter, you receive interest as per the chosen series and principal on maturity.

Why do companies do Bond IPO?

Companies raise debt from investors either in the form of Bond IPO (public issue) or via debt private placements. These private placements are mostly for large institutional investors only and usually out of reach of individual investors who may not have access to the timing/details of such issuances. Also, there are restrictions placed on a company by Security and Exchange Board of India (regulator) on:

- Number of private placements in a year

- High minimum investment amount. Hence the private placement market becomes a ‘big boys only’ investment option.

Initial Public Offering is done by companies to target individuals and raise capital from them. India has a very high savings rate of 28.35% in 2020 as per the World Bank (%age of GDP). IPO for Bonds aim to transfer this share of savings into productive investments for growth by tapping various sources of funds which may not be easily accessible otherwise. Companies find this form of retail investments to be beneficial as this provides a long term and additional pool of capital for them.

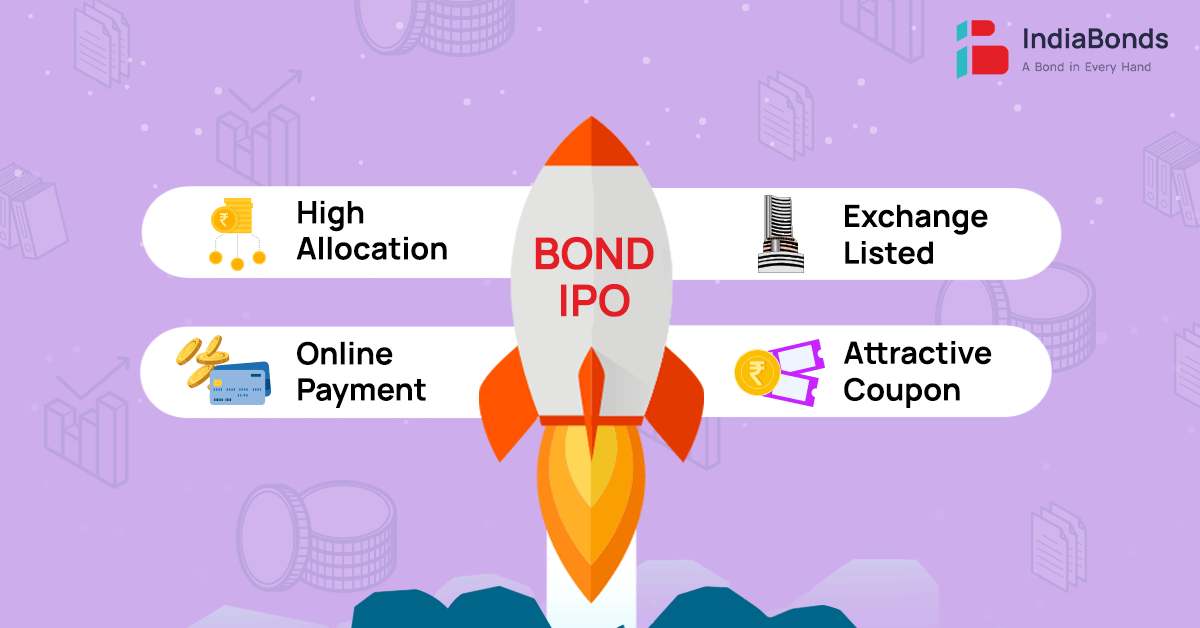

Benefits of Bond IPO for investors

Debt Public Issues are done to attract individual investors who can derive a lot of additional benefits by subscribing to these. A few key advantages are:

Low Minimum Investment: The biggest benefit of investing in Bond IPOs is that you can invest in bonds as low as Rs.10,000! This is truly a product for individuals and helps them to channel their savings, from meagre returns providing Fixed Deposits, to higher and stable returns from bonds.

Higher Interest Rates: Companies mostly offer higher interest rates to individuals than institutional investors in Bond IPOs. Hence, individual investors tend to benefit more.

Additional Disclosures: A Bond IPO in India is regulated by SEBI who requires companies to follow a detailed process of issuance as well as provide a lot more details as disclosures. This provides investors with detailed information regarding the issuer than in private placements.

Higher Allocation: A Bond IPO has a pre-allocated amount of bonds to individuals in the retail and HNI segments. In case the issue is a whopping success, investors are assured of a higher (if not full) allocation of the amount they want to invest.

Transparent Pricing: As a company raises large amounts of capital via public issue, the pricing is transparent for individual investors. They don’t have to conduct multiple checks through sources since the IPO has a uniform price.

Exchange Listing: Bonds in India are required by law to be listed on exchanges. This helps investors get access to regular performance updates from the company as per listing rules and arms them with better monitoring of their portfolio.

Secondary Market Liquidity: As the number of investors large for public issues, the bonds tend to have a much higher liquidity in the secondary market. This helps individuals to invest in bonds exit their investments easily and quickly versus other illiquid complex debt products.

Ease of Application: Subscribing to bonds in India is easy with an online process. Gone are the days of detailed paperwork. You can set alerts for forthcoming Bond IPOs and buy bonds online at IndiaBonds. All you need to do is add your personal details and requirements in a prefilled form.

Watch the video to learn more about Bond IPOs.

Risks to Understand Before Applying

Bonds are about stability, but they’re not risk-free. Credit risk comes first—coupon and principal depend on the issuer’s ability to pay; watch the rating, covenants, and security cover. Interest-rate risk matters too: if market rates rise, listed bond prices may fall (and vice-versa). Liquidity can be uneven on exchange; exiting mid-term might mean selling at a discount. Some series may carry call/put options that can change your expected holding period. There’s allocation risk in popular issues—oversubscription can lead to partial allotment. Finally, tax rules and regulations can change over time, affecting post-tax returns. Read the offer document, diversify across issuers/tenors, and invest an amount aligned to your risk capacity.

Taxation Rules for Bond IPO Investors

Interest from NCDs is taxable in your hands as “Income from Other Sources” at your slab rate for the year of receipt/accrual, as specified in the offer document. If you sell listed NCDs on the exchange before maturity, capital gains tax applies: short-term gains (typically holding period up to 12 months) are taxed at slab rates; long-term gains (usually beyond 12 months) may be taxed at a specified rate without indexation, as per prevailing law. Tax-deduction at source (TDS) may apply based on the issue terms and regulations in force. Always refer to the prospectus for issuer-specific tax notes and consider professional advice for your situation.

How to Apply for a Bond IPO in India

Check the basics: Review the issuer, credit rating, series options (tenor, coupon, payout—monthly/annual/cumulative), security/cover, and risk factors in the prospectus.

Complete KYC & demat: Ensure your PAN, KYC, bank account, and demat are active and mapped to your trading/OBPP account.

Choose your category & series: Retail/HNI categories have separate quotas. Pick a series that suits your cash-flow needs (periodic coupon vs cumulative) and holding horizon.

Apply via OBPP/broker/ASBA–UPI: Enter quantity and price (usually “at cut-off” for public issues). Approve mandate to block funds in your bank account until allotment.

Track subscription: Public issues disclose day-wise bids by category on exchange websites; popular tranches can fill quickly.

Allotment & listing: After closure, the registrar finalises allotment as per rules in the offer document. Allotted NCDs are credited to your demat; excess funds are unblocked/refunded. Issues typically list on NSE/BSE within the stated timeline, enabling secondary trading.

Post-issue servicing: Coupons are credited to your bank account on the declared dates; principal is repaid on maturity to the registered bank account. Keep your bank/demat details updated to avoid payment failures.

Payment Process and Allotment of Bond IPO

This is fairly straightforward for individual investors and can be done online depending on the size of your investments:

UPI – For application amounts up to INR 5 lacs, payments can be made via UPI. This stands for Unified Payments Interface (UPI) and is an instant payment system developed by the National Payments Corporation of India (NPCI), an RBI regulated entity. UPI allows you to instantly transfer money between any two parties’ bank accounts.

ASBA – For application amounts more than INR 5 lacs, payments can be made via ASBA which stands for Application Supported by Blocked Amount. This is an authorization to block the application money in their bank account for subscribing to a new bond issue.

Allotment of bonds or in a public issue is mostly done based on categories mentioned below. Here only 3 and 4 are relevant for individual investors:

- Institutional Investors – example are banks, mutual funds, insurance companies etc

- Non-institutional Investors – example company treasuries, trusts etc

- High-Networth Individuals (HNIs) – for applications higher than INR 10 lacs.

- Retail Investors – for applications up to INR 10 lacs by individuals or HUF

Unlike equity IPOs, allotments are done on a first come first serve basis. So it’s essential to subscribe in a Bond IPO at launch itself! Allotment in case of oversubscription is done by the Registrar on proportionate basis where retail category is given priority.

Who can Invest in Bond IPO?

Eligibility is defined in the offer document. Typically, Resident Individual investors (Retail and HNI), HUFs, corporate bodies, trusts, and other eligible entities can apply with valid PAN, KYC, bank account, and demat. NRIs may participate only if specifically permitted in the issue—check the “Eligible Investors” section closely. Many issues reserve distinct quotas for Institutional, Non-Institutional (HNI), and Retail categories; minimum application size and lot size are also specified. Applications must be submitted through permitted channels (OBPPs/brokers/ASBA/UPI) during market hours on the exchange bidding platform within the issue window. Always verify your category, limits, and any restrictions before applying.

To conclude, a Debt Public Issue or Bond IPO is a very convenient and beneficial way for individuals to invest in the bond market. Topping it all off, it’s now even easier to monitor and buy bonds via the convenience of IndiaBonds platform. For those who cannot wait for the next Public Issue – do not worry! Here’s a wide range of secondary bond offerings on our bond market at IndiaBonds.com

Disclaimer: Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.