Bonds are a great investment tool, both for investors looking to diversify their portfolio and for bond issuers as a way to raise funds. It is a loan that is given by you as an investor to the borrower. Bonds are a fixed income instrument that can be used by a company, governments, and municipalities to raise money. It is used to finance projects, grow their R&D department, or any other operations. There are various kinds of bonds available to the public such as Government Bonds, Municipal bonds, Corporate Bonds, and Asset-backed bonds.

When a company, institution or government issues bonds, an agreement is made between the borrower and the investor. It says that the borrower will pay the principal amount on the maturity date. A bond yield calculation needs three different factors. This includes the principal, the coupon rates, and the maturity dates. A bond can be issued in both public and private placements.

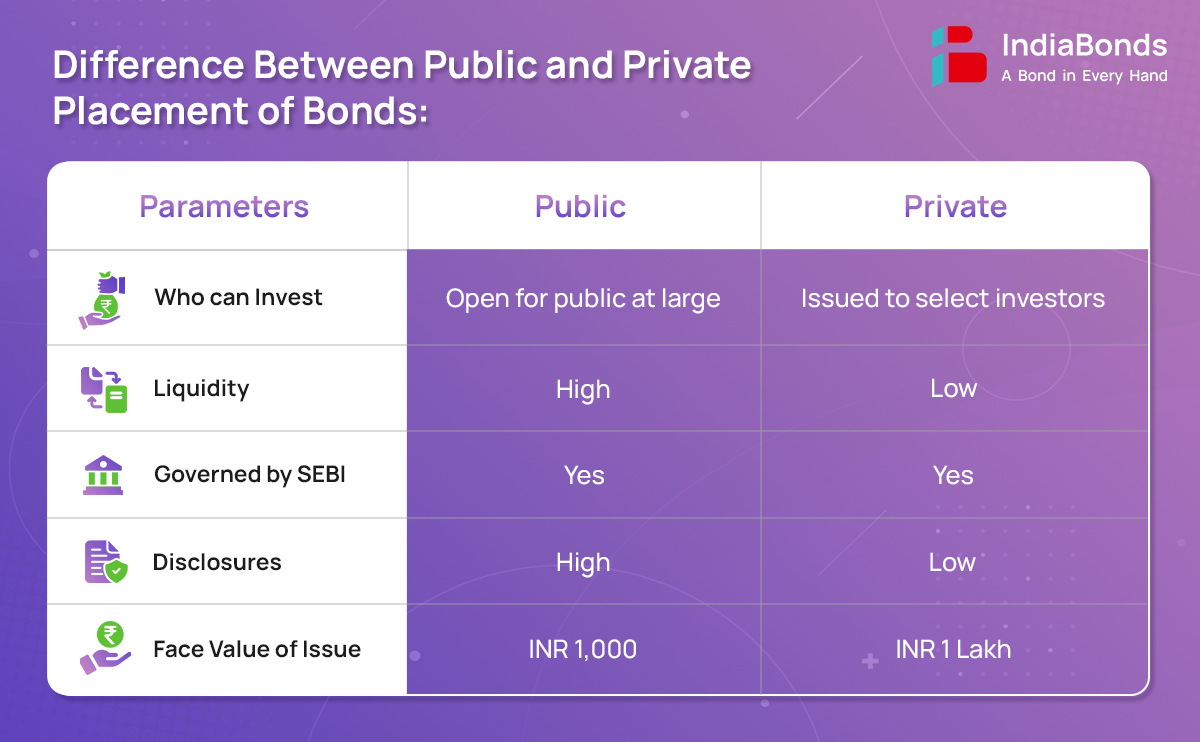

When a company decides to issue its bonds to the public at large it is known as a Public Placement of Bonds. If a company goes for a Public Placement of Bonds, then it is open to more review from the public. Private placements have no review. These kinds of bonds are listed on the exchange. The investors can apply to subscribe to the bonds. They can apply for the purchase of these bonds directly.

As these are listed on the exchange they have better liquidity. The borrower must submit a wide range of documentation regarding the company and the transactions since a public securities exchange has a large investor base. The issue due diligence is done by investment bankers. These issues of bonds are overlooked by SEBI (Securities Exchange Board of India). It keeps a close watch on all the transactions that take place on the securities exchange.

Private placement bonds are a contrast to public placement. Here the bonds are issued to select investors or institutions. The company doesn’t have to file a document before issuing the bonds. Most of the corporate sectors choose private placement of bonds because of the benefits it brings with it, beneficial to both companies and investors alike. Private Placement of Bonds are also a time-saving method for raising money as it comes with less paperwork and compliance formalities. The companies also don’t have to be involved in any form of announcement, general solicitation, or seminar. However it’s important to note that the private placement of bonds are governed by SEBI.

This means of fund raising has emerged as an alternative funding source for businesses that require less paperwork. When it comes to value, private placements only stand second to bank financing. The use of funds can be similar to public placement such as acquisitions, projects, refinancing debts, expansion, and more.

Organizations choose the form of Bond placement basis their set objectives. If they wish to have a larger customer base and are okay with sharing their crucial company information with the public then they most likely go for Public Placement of Bonds. Companies that don’t want to make their business details public, prefer Private Placement of Bonds. As they come with compliance of minimum regulations and a time saving issuing process. It also allows the company to sell complex bonds to investors who understand the risks and benefits.

In Public Placement the rates are higher to attract investors. While in a volatile market, the firm can quickly determine the yield, pricing, and structure via a private placement.

To increase public bond issues, the corporate bond market needs to be more liquid. It can also be boosted by creating awareness among retail investors by educating and incentivizing them. They have to be encouraged to participate in these public issues of bonds and diversify their investments.

Companies opt for private placement as they have less paperwork and no detailed compliance. It is a very cost-effective and time-saving method to raise money. It is a very economic model with less stringent disclosure and due diligence. Companies also prefer it as a lot of intermediaries are involved that help in reaching the target investors. They also enable negotiations and price discovery.

Disclaimer: Investments in debt securities are subject to risks. Read all the offer related documents carefully.