The RBI’s Monetary Policy Committee (MPC) conducted its monetary policy meeting from December 6-8, 2023.

On the basis of an assessment of the evolving macroeconomic situation, the Monetary Policy Committee (MPC) made the following announcements:

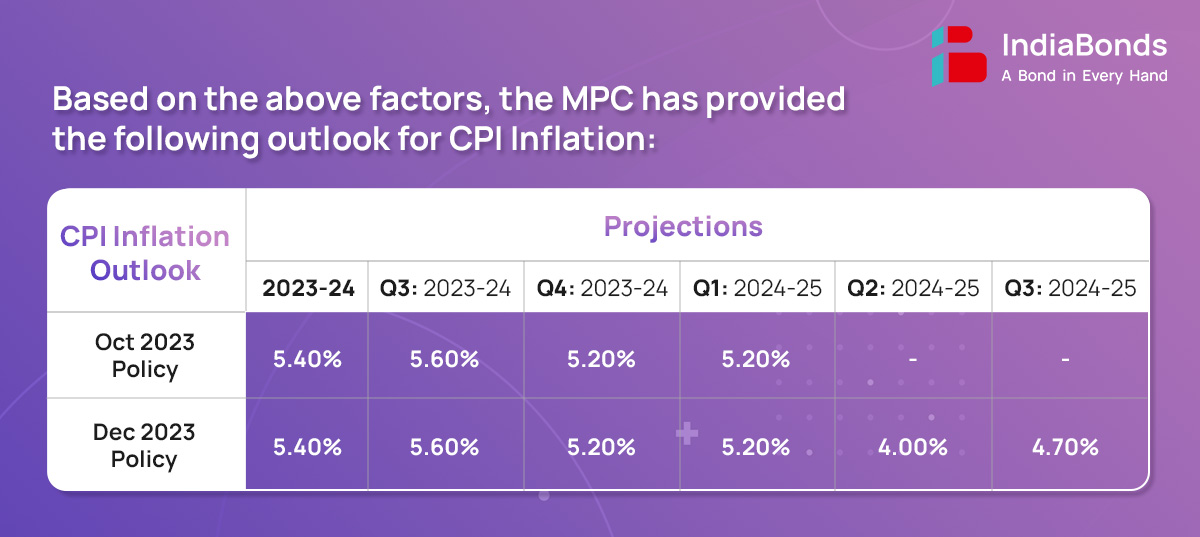

CPI headline inflation fell by about 2% points since the last meeting of the MPC to 4.9% in October 2023 on sharp correction in prices of certain vegetables, deflation in fuel and a broad-based moderation in core inflation (CPI inflation excluding food and fuel).

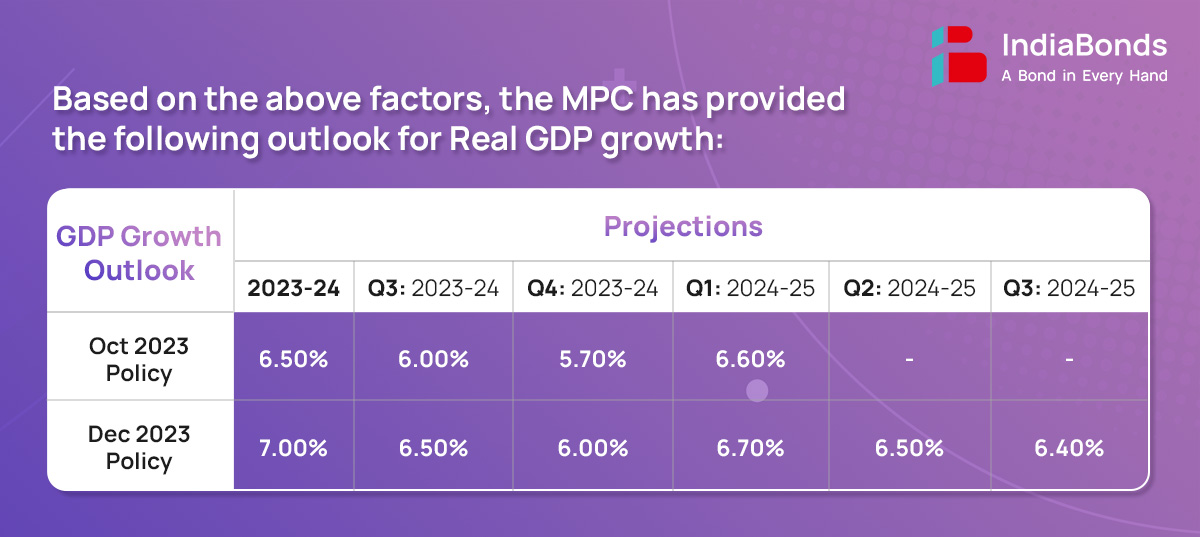

Domestic economic activity is exhibiting resilience. Real gross domestic product (GDP) grew year-on-year (y-o-y) by 7.6% in Q2:2023-24, underpinned by robust investment and government consumption, which cushioned the drag from net external demand. On the supply side, gross value added (GVA) rose by 7.4% in Q2, driven by buoyant manufacturing and construction activities.

Global growth is slowing at a divergent pace across economies. Inflation continues to ebb though it remains above target with underlying inflationary pressures staying relatively stubborn. Market sentiments have improved since the last MPC meeting – sovereign bond yields have declined, the US dollar has depreciated, and global equity markets have strengthened. Emerging market economies (EMEs) continue to face volatile capital flows.

The regulatory framework hedging of foreign exchange risks has been made more comprehensive by consolidating the directions in respect of all types of transactions – over-the-counter and exchange traded – under a single Master Direction. The framework would enhance operational efficiency and ease access to foreign exchange derivatives, especially for users with small exposures.

Connected lending or lending to persons who can control the decision of a lender can lead to compromise in pricing and credit management, if the lender does not maintain an arm’s length relationship with such borrowers. RBI has decided to come out with a unified regulatory framework on connected lending for all the regulated entities. A draft circular will be issued for public comments.

RBI has decided to bring loan aggregation services offered by the Lending Service Providers (LSPs) under a comprehensive regulatory framework which will focus on enhancing the transparency in the operations of WALPs, increase customer centricity and enable the borrowers to make informed choices.

To encourage the use of UPI for medical and educational services, it is proposed to enhance the limit for payments to hospitals and educational institutions from ₹1 lakh to ₹5 lakh per transaction.

RBI proposed to exempt the requirement of Additional Factor of Authentication (AFA) for transactions up to ₹1 lakh for the following categories, viz., and subscription to mutual funds, payment of insurance premium and payments of credit card bills. The other existing requirements such as pre- and post-transaction notifications, opt-out facility for user, etc. shall continue to apply to these transactions.

RBI will establish a cloud facility for the financial sector to enhance the security of financial sector data and business scalability. The cloud facility will initially be operated by Indian Financial Technology & Allied Services (IFTAS), a wholly-owned subsidiary of RBI and eventually, will be transferred to a separate entity owned by the financial sector participants.

RBI has proposed to set-up a repository for capturing essential information about FinTechs, encompassing their activities, products, technology stack, financial information etc. FinTechs would be encouraged to voluntarily provide data to the Repository which will aid in designing appropriate policy approaches. The Repository will be operationalized by the Reserve Bank Innovation Hub in April 2024 or earlier.

The next meeting of the MPC is scheduled during February 6-8, 2024

Disclaimer: Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.