Blogs

Difference Between Zero Coupon Bonds and Deep Discount Bonds

The fixed deposit represented the quintessential example of the Indian investor’s behavior. It meets all the requirements that an average Indian seeks – safety, predictable returns and the assurance of receiving their money back on time. However, in the early 1990s, deep discount bonds emerged as a challenge to the established order. Investors were attracted […]

Sovereign Gold Bond vs Digital Gold

In the past decade, the digital revolution in India has caused a stir. We no longer only use technology to order food, clothing and appliances, but can also purchase cars and jewellery online. Furthermore, the wealth-tech sector has seen the emergence of numerous online players offering financial products and services. Gold, which is highly valued […]

Bonds vs Equities or Stocks

What is the most common question that every financial advisor receives? What is the most discussed topic in every investment forum, financial planning and investment advice literature? And what is the all-time, go-to topic for a “fin-fluencer” to create content on? Bonds vs Equities Bonds and stocks are the two most talked-about asset classes in […]

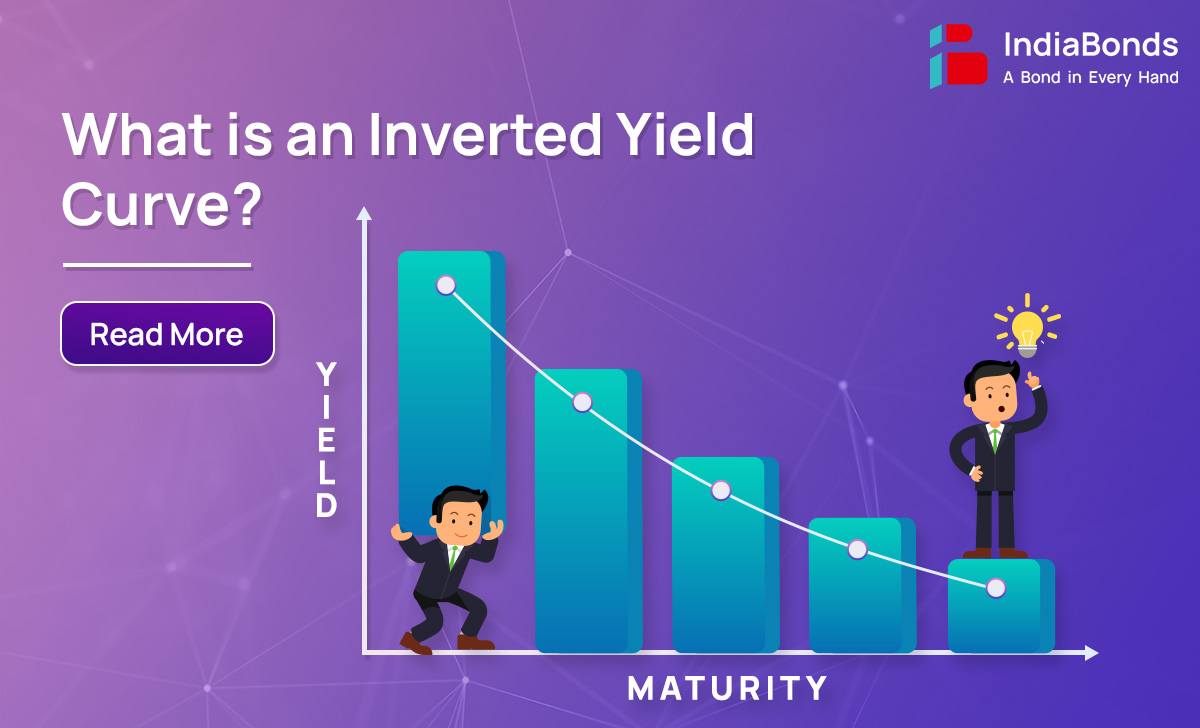

What is the Inverted Yield Curve and why it matters

In the world of bond investing, the term “yield” is synonymous with “return.” When referring to the “yield” of a 10-year Government Security (G-Sec), it communicates the 10-year return on that particular bond. The yield curve is a graph that shows the relationship between the yields and the maturity dates of a series of bonds. […]

What is G-Sec and State Guaranteed Bond?

Generally, in a developing economy, the expenditure of the central government surpasses its earnings, resulting in an outflow of funds that exceeds the inflow, which is known as a fiscal deficit. To address this deficit, the central government can resort to two measures: printing notes or issuing government securities (borrowing money). However, consistently printing notes […]

Bonds vs Fixed Deposits

In the world of fixed income securities, Bonds and Fixed Deposits (FDs) are two dominant players, each with its own advantages and limitations. While FDs are widely used, bonds remain largely overlooked. In 2017, SEBI conducted a survey* to study investment patterns in households, which revealed that over 95% of households, preferred FDs as their […]

Navigating the Risks of Bond Investing

Mr. Mahesh had always been wary of bond investing. He had heard stories of investors losing money in bond investments because the company defaulted, and the thought of taking such risks made him very anxious. For years, he avoided any investment opportunity that involved bonds, even though his financial advisor tried to explain the benefits […]

What Is The Role Of A Debenture Trustee In Bond Issuances?

Non-Convertible Debentures (NCDs) or simply ‘Debentures’ are long-term debt instruments issued by companies to raise funds from the public or institutions. These are also commonly referred to as ‘Bonds’. A debenture trustee is an independent third party appointed by the company to safeguard the interests of debenture holders. Debenture trustees play a critical role in […]

Bond Redemption – Types of Bond Redemption

What is Bond redemption? Bond redemption is the process by which a bond issuer repays the principal amount of a bond to the bondholder on the bond’s maturity date. When a bond is issued, it has a specified term or maturity date, which is the date when the bond issuer is obligated to pay back […]