#Essential

What is Coupon Rate?

Imagine you’re thinking about lending some money, right? Buying a bond is kind of like that. The company or government you buy the bond from is borrowing from you. Now, for lending them your cash, they give you regular interest payments. The coupon rate is simply the fixed percentage of the original amount you lent […]

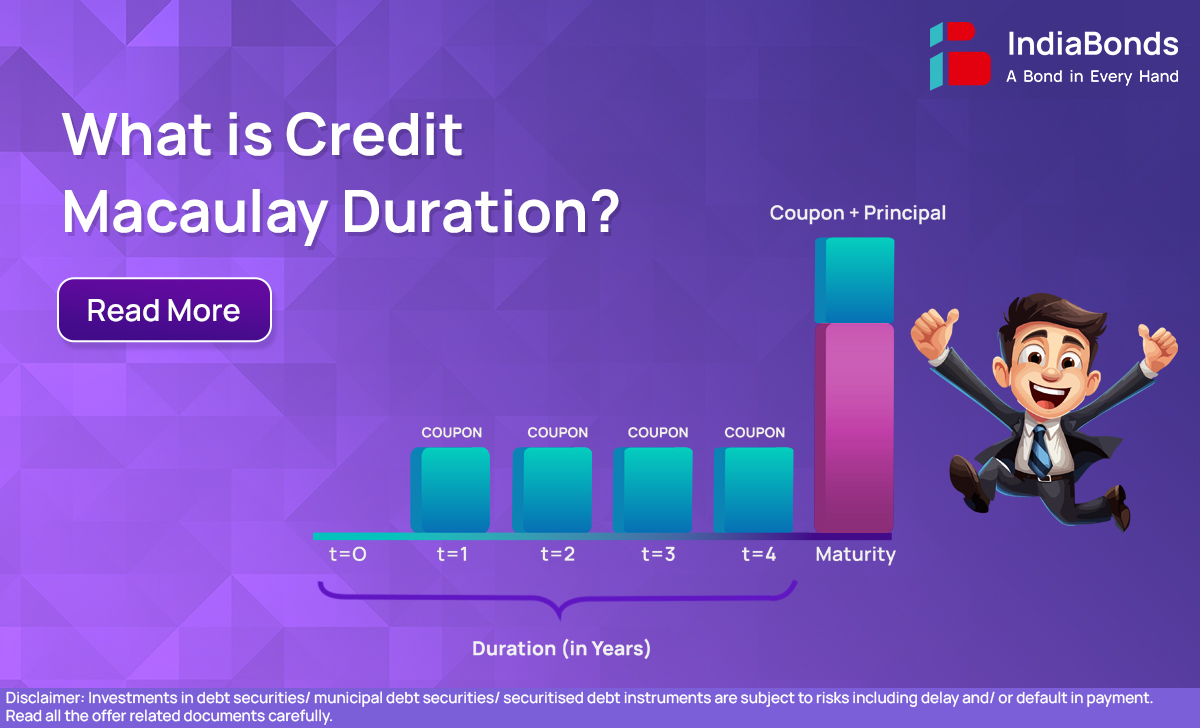

What is Credit Macaulay Duration?

Introduction When you invest in bonds, especially those issued by corporations or lower-rated entities, understanding how long your money is at risk and how sensitive the bond is to interest rate changes becomes critical. One widely used concept in the bond world is Macaulay Duration. It helps investors get a sense of when they’ll recover […]

What is a Dealer?

In everyday finance, the word Dealer pops up often, yet most investors are unsure what it really means. A Dealer stands ready to buy and sell securities on their own account, providing prices, inventory and liquidity. Without the Dealer, many trades would slow down or fail altogether. What is Dealer? So, what is Dealer in […]

What is Default?

Money runs on promises. When someone cannot keep up with those promises—like paying back a loan or honoring a contract—it’s called a Default. It sounds technical, but in reality, Default is simply about trust being broken in finance. And once trust is broken, the effects spread quickly. What Is a Default? People often ask: what […]

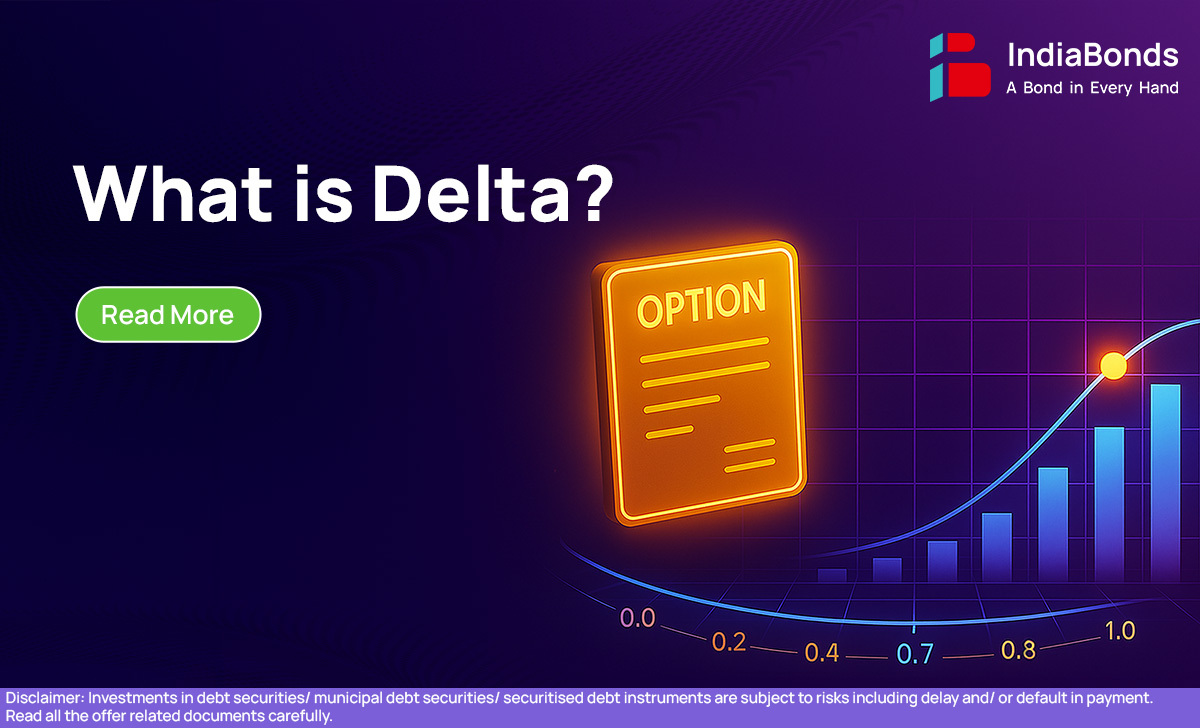

What is Delta?

Definition Delta in investing, particularly in options trading, is a measure of an option’s price sensitivity to a Re. 1 change in the price of the underlying asset. It is one of the “Greeks,” a set of risk measures used in options trading. What Is Delta? And Key Takeaways Delta is a way to see […]

What is Discount Rates?

People often assume the value of money is fixed—₹1 lakh is ₹1 lakh. In reality, timing changes everything. Money received today can be invested, used, or kept liquid; money received later carries uncertainty and opportunity cost. That gap between “today” and “later” is where discount rates come in. They help translate future cash flows into […]

What is Face Value?

Every investor has bumped into the term Face Value—sometimes on a bond statement, other times in an IPO booklet. At first glance, it feels like a small detail. But this simple number quietly shapes how much you earn, how companies calculate dividends, and how bonds are repaid. What Is Face Value? So, what is Face […]

What is G-Sec and State Guaranteed Bond?

Generally, in a developing economy, the expenditure of the central government surpasses its earnings, resulting in an outflow of funds that exceeds the inflow, which is known as a fiscal deficit. To address this deficit, the central government can resort to two measures: printing notes or issuing government securities (borrowing money). However, consistently printing notes […]

What Is a Green Bond & How Does It Work?

The concern for the environment is growing and the government and corporates are taking active steps to reduce the activities that have a hazardous impact on the environment. Apart from that, active steps are being taken to create and develop projects that are more environmentally friendly or create a positive environmental impact. This is where […]