Issuers of Bank Bonds

As of July 2022, there are Rs. 75,000 crore worth of AT1 Bonds trading in the market,

and Rs. 1,25,000 crore worth of Tier 2 Bonds being actively traded in the secondary market. More than 85-90%

of PSU banks issue Bank Bonds in India.

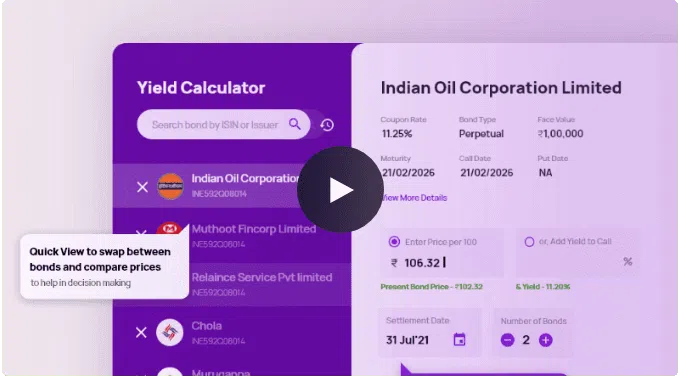

To buy Bank Bonds, it is important to remember that not all Bank Bonds in India

are created equal. Generally, these bonds fall into three categories:

Bank Senior Bonds: They are issued to fund long-term

infrastructure projects. Although unsecured, they are on par with the bank's depositors and other

uninsured/unsecured creditors and have a minimum term of 7 years. There are no embedded options in this bond.

Tier 2 Bonds: Banks issue subordinated Tier 2 bonds to fulfill

their Tier 2 capital requirements. These bonds have a minimum term of five years and are unsecured and

subordinated to depositors, unsecured creditors, and senior bonds of the bank. Bank Tier 2 bonds only have a

Call Option, which allows the bank to repay the bonds early after five years. Bank Tier 2 bonds pay a higher

interest rate than senior bonds due to their loss absorption feature.

AT1 Bonds: AT1 bonds are unsecured, subordinated to Tier 2

bonds. They have a 5-year call option. AT1 bonds are perpetual, meaning they have no maturity date and pay a

high coupon rate. AT1 bonds carry a minimum ticket size of Rs 1 crore. They come with the loss absorption

feature i.e. if the issuer's capital position deteriorates, the value of the AT1 bonds may be written down or

converted into equity to help strengthen the issuer's balance sheet.