#Essential

What are State Development Loans – Meaning, Features and Benefits

In one of the previous articles, we learned about how the government issues g-secs to fulfill its fiscal requirements. Similarly, state governments issue bonds, commonly known as State Development Loans (SDLs), to meet their budgetary needs. State development loans are debt instruments issued by state governments in India to fund its developmental activities. In the […]

What are Tax-Free Bonds?

Introduction Tax-free bonds are the only fixed-income form with no associated tax liability on the interest earned. You can invest in tax-free bonds and keep 100% of the interest you receive each year. In India, the government or any public sector undertaking can issue tax-free bonds to the public. These bonds are a safe choice […]

Factors Affecting Bond Prices

A bond can be viewed as a debt security issued by a company or governments to finance their capital expenditures and fund growth projects. Simply put, it is a form of loan taken by corporations or governments. Bonds usually offer regular and fixed returns, which make them one of the most stable investment options in […]

Zero coupon Bonds

Zero-coupon or discount bonds are debt security instruments bought at steep discounts and mature at their face value without paying interest throughout their term. These bonds offer the total face value at maturity, giving a significant return equivalent to the interest gained over time. Ideal for investors seeking a simple and effective investment strategy, they […]

What is a Bond? What are the Features of a Bond?

A bond is a popular investment option for a person having limited appetite for risk or wanting a steady source of income. If you are looking at investing your funds towards an instrument that can give you a fixed income and lesser volatility, investing in a bond is a good choice for you. What is […]

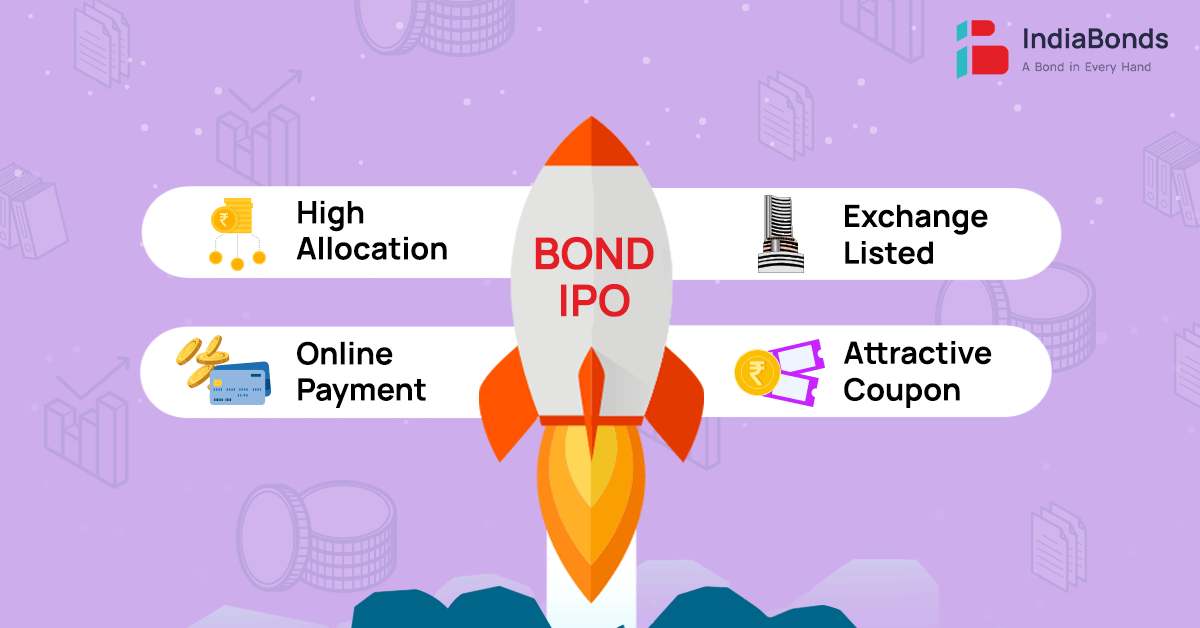

What is a Bond IPO – Debt Public Issue

Introduction Economic growth for a country is led by public investment done by the government and private investment done by companies. This requires money (or capital) from other people; as owners themselves may not have all the resources to invest in growth. Traditionally in India, banks have been the primary source of capital for firms. […]

What is a Collateralized Debt Obligation (CDO)?

Introduction Most people are comfortable with the idea of a plain bond: lend money, get interest back, and receive principal at the end. A collateralized debt obligation sounds far more technical, but the idea becomes friendly once it is broken into everyday terms. Imagine a big basket filled with many loans and bonds. Instead of […]

What is a convertible bond? Difference between convertible and non-convertible bond

Introduction Investors are diligently looking for the necessary and sufficient information regarding their investment goals and the financial instruments they have chosen. Bond investments have been the talk of the town in recent years, and sufficient information is being made available through numerous means. However, some early investors are still unclear about the notions of […]

Fixed Deposit by IndiaBonds

Introduction Everything has a price, and every price has its return. Fixed Deposits (FDs) are the embodiment of safety for Indian investors. They have existed since the time of our grandparents and parents and have been their preferred choice for savings. For a more in-depth look at ‘Why Your Parents Chose Fixed Deposits,’ click here. […]