#Essential

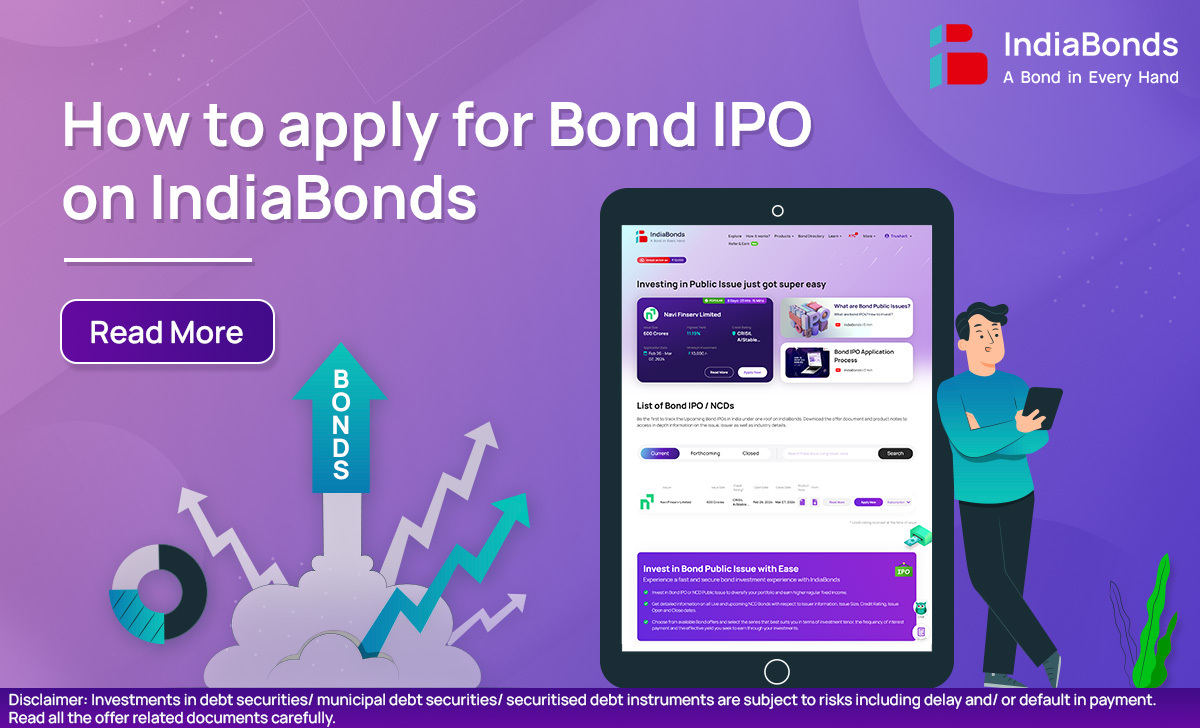

How to apply for Bond IPO on IndiaBonds

Introduction Bonds are like the steady hand in your financial journey, providing a reliable stream of revenue and helping to shield your investments from the ups and downs of the market. They’re like your safety net, ensuring that even when other assets in your portfolio are fluctuating, you have something secure to rely on. Just […]

How to Buy Corporate Bonds in India

Introduction Mr. Mehta, a diligent accountant in the 90s, is eager to invest in a corporate bond. He leaves work early, navigates through the bustling streets to meet his broker and sits down in a dimly lit office surrounded by stacks of paperwork. After painstakingly filling out numerous forms and writing a cheque, Mr. Mehta […]

How To Calculate Bond Yield Online?

Return on investment is one of the key drivers for your investment decision. In the case of bond investment, bond yield represents your return on investment. It is the percentage return on a bond investment and is represented as the ratio of the annual coupon payments to the bond’s current market price. The higher the […]

How to Calculate Yield to Maturity?

Introduction Investing in fixed-income instruments is a great way to secure a passive income while reducing portfolio risk. Bonds are one of the best examples when it comes to investing in fixed-income securities. The interest that bonds pay to the bondholder is often represented as the coupon rate. For instance, if a corporate bond has […]

What are Government Bonds? How to invest in Government Bonds Online

Introduction In a buffet of debt investments, while the humble Government Bonds may not rank as the most enticing dish in comparison to other investment options, the foundation it can provide your investments is unparalleled. It wouldn’t be farfetched to say that in most countries, these government securities play an essential function in the entire […]

How To Open Post Office Fixed Deposit Account Online

If you grew up in an Indian household, chances are the post office wasn’t just a place to mail letters. It was where passbooks lived, where grandparents parked savings, and where money felt… safe. That trust hasn’t disappeared. Even today, the Post Office Fixed Deposit is a familiar choice for people who want peace & […]

Bond Calculator

When it comes to investing, especially in fixed income securities, making informed decisions is crucial for success. One of the most essential tools for investors is the bond calculator, which allows us to calculate the price and yield of bonds with precision. IndiaBonds, a SEBI-Registered Online Bond Platform Provider, offers a sophisticated bond calculator that […]

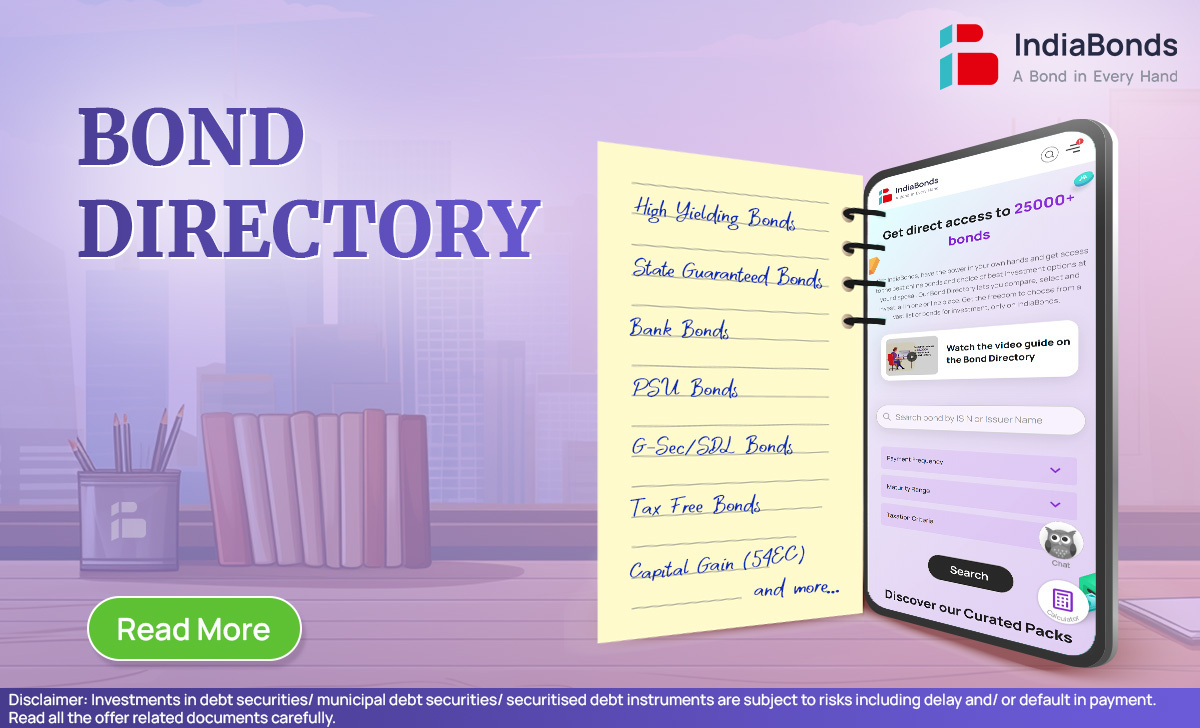

Bond Directory

Investing in bonds has often been seen as a daunting task due to the complexity, jargon and sheer volume of available options, making the fixed income market seem impenetrable and tricky. IndiaBonds, a SEBI-Registered Online Bond Platform Provider, aims to democratize access to this market. With its revolutionary tool, the Bond Directory, IndiaBonds simplifies the […]

The Indian Government Securities Market: Types and Overview

The government securities (G-Secs) market stands as a crucial pillar of the country’s financial system, playing a pivotal role in raising funds to finance government expenditures and maintaining economic stability. With its vast scope and multifaceted nature, comprehending the intricacies of this market is paramount for investors and financial enthusiasts. The Indian bond market is […]